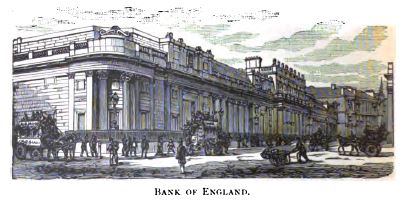

How to Make Money – Banking & Insurance – Part I April 8th, 2018  Royal Exchange and The Bank of England From How to Make Money; and How to Keep it, Or, Capital and Labor based on the works of Thomas A. Davies Revised & Rewritten with Additions by Henry A. Ford A.M. – 1884

CHAPTER XXVI

BANKING AND INSURANCE.

I wish I could write all across the sky, in letters of gold, the one word, SAVINGS-BANK. Rev Wm. Marsh

The relations of the banking system to the operations of general trade are so intimate and indispensable that every man of business should be acquainted with their nature and extent. James D. Mills

Insurance is to-day recognized as not only an integral and necessary factor in the commerce of nations, but it is imperatively demanded for the establishment and maintenance of commercial credit among all civilized peoples. To such importance has it grown that governments have acquired immense revenues by taxing the income derived from it, and have in some instances assume greater or less control over it. Insurance Year Book

BANKS are of three kinds -of discount and deposit, individual or private, and savings-banks. They have all but one object—to make money with money. This principle is all-important with the money-maker; and to know how this is done is to accomplish a great object. This chapter will not presue to give such institutions or individuals any information how it is to be done; for their success generally is a proof that they understand that. Further, it is an occupation—that may me considered a trade within itself— requiring long experience, large knowledge of values, good judgment, rare firmness, and in fact every business qualification in high perfection. Reference to banking as one of the most extensive means of making money with money, is simply to show the moneymaker, after he has got his dollar, how others manage their dollars to advantage, so that he may know the danger of managing his own with his trifling information—a subject which requires superior knowledge and high acquirements to do well.

No statistics are at hand to compare directly any other trade or business with banking in the particular of success. An interesting fact, however, was asserted by an officer of an old Boston bank, that an investigation of their books revealed the fact that, of the one thousand accounts opened with it in starting, only six remained with it forty years afterwards. The parties to all the others had either failed or died destitute of property. The bank had stood, while nine hundred and ninety-four traders out of one thousand had gone down. It can probably be asserted with safety that not five per cent of failures occur in any regular banking business, while there are ninety to ninety-five per cent among commercial houses. Both deal substantially in the same things, the one class in the articles themselves, the other in the paper representing their value. This fact is sufficient to awaken the mind of the merchant or trader to an investigation of the manner in which banks handle their values—what they do, how and when they do it, and how they happen to succeed when so many others lose and fail. And now, Mr. Trader, or Sir Merchant, if you are wide awake enough to this fact to push the investigation and profit by it, you are prepared for a better day’s work than you ever did in your life. But more likely you will say, “Pooh! a bank is one thing, a mercantile business another.” You say the truth, indeed, as both are conducted at the present day. The result, however, is that the one is a success, while the other is a failure.

But not the trader alone is interested in this question: it is for every one who has made a dollar or who is in the way of making it, to be interested in knowing the machinery of banking, how money is made from money, and further, to know that it requires machinery of a peculiarly delicate nature, and specially well managed, to accomplish the object, at least in this particular way of making money with money. More than half the people who have labored for their dollar do not know that such machinery can have the least bearing upon what they have made, and that putting it through this machine, or some process like it, will send it forth increased in value. The trouble is that they generally put it into some kind of a machine which never allows them to see it again at all, much less any increase from it.

Can the fine, exact machinery of a mint be made by a novice? or can it be managed by one totally ignorant of its construction’? Just as well might a man attempt to increase his means without some knowledge of the necessary machinery, as to coin a standard dollar without knowing the process by which it is coined, and having the faculty to use bis knowledge in the coinage. The trade of multiplying dollars by making dollars work is not caught up in the inspiration of the moment, and he who has a dollar to set at work must know well how the work is to be done; he must find a machine that is known to do this kind of work well, or loss of it is the inevitable result. Hence the long, sad list of failures and wide-spread poverty among our most worthy and energetic men—not to accomplish or earn, or even to amass, but to save, because their dollar has gone into the wrong machine.

The process of banking is the machinery required in order to make money with money. What is this process? In banks of discount and deposit, a number of capitalists generally put in a sum of money apiece, and receive therefor certificates of stock, according to the amount of their subscriptions. The stockholders duly assemble and choose several of their own number for directors, who in turn meet and elect a president, cashier, and sometimes other officers. In their bank people leave (deposit) their money for safekeeping within convenient reach; and the original money subscribed by the stockholders, with the deposits, makes a capital with which to purchase moneyed, interest-bearing securities—generally notes of hand, representing property of different kinds. The bank is then ready for business—to loan the money on short dates for an increase.

The whole matter is very simple to this point, and almost anyone could go through it. But now comes the tug of war, for success or failure, even in this business. A merchant enters with a note he has taken for goods sold, and says to the Cashier, “I wish you would give me the money on this.” The answer is, “I will hand it to the President, and give you a reply after the Board meets.” The President lays the applicant’s paper before the Board of Directors; and if it is strongly endorsed and has collateral security enough to make the loan perfectly safe, the note is “done,” as it is called, and the merchant gets his money.

Do you see anything in this process to attract attention? When you take a note, or part with property or money, do yon do anything of this kind? Do you submit your financial transactions for the approval or rejection of two shrewd, trained business men, who, not content to rely solely upon their own

judgment, summon to their aid a number of other first-class business men, to pass upon the security offered? Bear in mind that in the very first instance they require at least two good, strong names to start with, or equally safe collateral security, and then that the line of payment is usually very short— from thirty to ninety days. Sometimes a bank loses even with these precautions ; but not very often. By requiring two names and making the time of payment short, one or the other is pretty certain to save the loan. No business transaction has not some risk, the main thing being to reduce that risk by every devisable precaution as low as possible. In the matter of taking a note, twelve to fourteen able and longtrained business men carefully consult as to the value of the security proposed, and everyone is pecuniarily interested in the result. An isolated person, then, who has a security to take, can consult no one else who has a like intercst with him. Such investments are generally made upon reference to persons who have no interest with the one who parts with his property, but whose interest as a general rule is to have you part with your property, that they may get pay for the property with which they have parted.

Now, do you think a bank would part with its money on such terms or such representations? If it did, anyone knows what would be the result. Do you wonder, then, that on such a system of credits traders fail, or that banks succeed by such care, caution, and scrutinizing discrimination? The banks divide their earnnings periodically among the stockholders, who make new investments in similar kind; while the trader declares no dividend, puts nothing away to the good, but keeps all his eggs in one basket, subject to the vicissitudes of trade.

Banks of discount and deposit are useful, as a means of making money with money, to those who have com, comparatively large sums to set at work. But there is a class of moneyed institutions called savings-banks, in which any person can in like manner set any sum at work, from one dime upward. But the amount of profit derived is not generally so great as in the banks of discount and deposit. The savings-banks will receive separate treatment presently.

Although banks present so far the nearest approach to perfection in the interchange of values represented by paper, there are certain general principles that will materially increase these earnings. They may briefly

be stated to be,—

- First, the business qualifications of its officers.

- Second, judicious selection of its credit.

- Third, the current expenses.

- Fourth, general reputation.

The personal popularity of the officers of a bank, and the manner in which customers or depositors are treated, either win or lose money for the concern, the same general rules of courtesy holding in these cases as in transactions between merchants, or between them and their customers. No thoughtful business man will neglect this principle, whether he is in a bank or any other business where his profits depend upon people who have a choice, and can take their money at discretion to one or to another. If a depositor goes into a bank to get some of his money, and a teller makes him wait while he finishes a long chat with a fellow-clerk or adds up a column of figures as long as his arm, which he could just as well postpone a moment, the underling is unfit for his place and is a damage to the bank—money actually lost to it. Say what you will, the waiting man feels uncomfortable; and instead of using his influence to advance the interests of that institution, he will hold it back, if he does not inflict damage in some way. Instead of an active friend, the bank will have but a cool one, if not an open enemy; and there is no telling when his influence, by a single word, may not strike to its damage or loss. So any other carelessness or neglect, on the part of a bank officer or employee, will tend to the same result.

On the other hand, to be polite, attentive, agreeable to all, at the same time doing business on business principles, will bring many dollars into the deposit-line, and long keep them there. The bank will make powerful friends, whose influence will be exerted to bring it new business and open new avenues of profit. An interest in the welfare and prosperity of the institution is lighted up, that will serve as a watchfire for its interests, and give the alarm when danger of loss appears. A general reputation and thrift will be infused into its whole business, which will roll in heavily on the deposit-line and out heavily on the dividends. In time of trouble all will pay such an institution who can.

Savings-banks are organized and conducted by persons of much practical knowledge and financial skill, for the benefit of those who desire to save and improve small sums of money, but do not know where or how to place them at interest, and yet have them subject to their call. The savings-bank was started by Miss Priscilla Wakeham, of the Parish of Tottenham, Middlesex, England, nearly a century ago, and after some years had a yery rapid growth. The plan is eminently useful and truly charitable. It requires a convenient building for its business, and the usual officers to conduct it. They take deposits, large or small, and invest them in good-sized sums at higher rates of interest than they pay depositors, the difference being used for current expenses and salaries. The interest received is usually seven per cent or more, and that paid depositors is four to five per cent, and even less for very short periods of deposit.

The bank holds itself ready to meet obligations to depositors at all times, on demand. The advantage resulting to the depositor is apparent, since he can not invest small sums safely in any other way. He generally knows nothing of practical financiering, and it would be costly for him to get security by any other means. Other securities, too, are not always convertible into cash without some percentage of loss.

Too much can hardly be said in favor of savings institutions for the protection of earnings and as incentives to economy. They supply a safe and certain means by which in a few years, as we have already seen, an independence can be attained, and the money that represents it is always within reach. The money that a mechanic, day-laborer, domestic, operative, or other wage-worker, spends in trifles that add neither to his comfort nor happiness, is a powerful stream of wealth, which, if poured into a savings-bank, soon becomes a large amount of money. The first dollar thus saved and fast anchored, becomes the nucleus of further and rapid additions, and the taste for economy and desire of accumulation will grow with every successive deposit. Such a person becomes a conservative member of society, a good, prosperous citizen. When a man or woman has made the first deposit, from that moment his or her services are more valuable, and higher wages can be commanded. It is a guarantee or endorsement that the depositor’s course of life is to be governed by principles of economy and habits of saving, and that the property of an employer is not to be wasted or destroyed. Noon, then, should fail to make a first deposit, or to train himself to strict principles of economy, the cutting off of such expenses as are not really necessary for either comfort or respectability. It should be remembered, also, that such a course commands general respect and uplifts the depositor’s character. One feels more independent, and carries the evidence of it in his whole bearing and demeanor, when he is free of debt and has money at interest. If this statement should be challenged by anyone, let him try it, and he will find, from the instant of success, that he lives in a new world. Any person, no matter what his walk in life, is more esteemed and more deferred to by his fellows if he is known to be without embarrassments or encumbrances, and has, money at his disposal. The same rule governs the coachman, the housemaid—classes of persons. Let it become known that an industrious young working man or woman has a bank account, with his bank-book as the evidence of it; and though the amount of his deposit be wholly unknown, the mere fact of it gives one importance and influence. There is no surer way for a young woman to get a husband, and most likely a good one, than to have a good sum in bank.

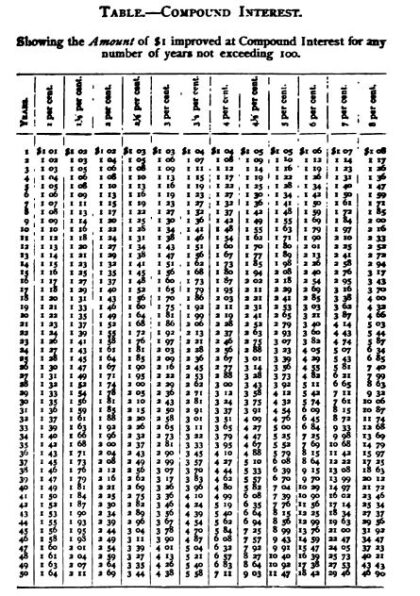

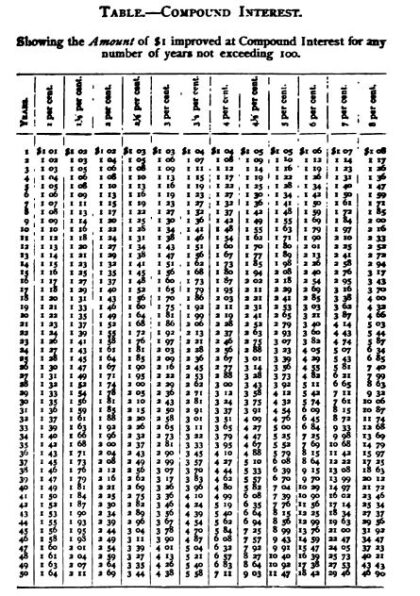

Upon the next two pages we give tables showing the wonderful results of compounding interest for terms of one year to one hundred years, and at rates from one to eight per cent. Upon the basis of the one dollar given, the amount for any sum may be computed. Thus, to find what $50 will come to in twenty years, at four per cent interest, find the result for one dollar in the table, which is $2.19, and multiply it by fifty, which gives $109.50. These tables are highly interesting and valuable, and should be carefully studied.

Under the head of Insurance are classed several varieties—among the more common fire, marine, inland, accident, and life, among the rarer tornado, livestock, and plate-glass insurance. All belong to the class of business we are considering—money-making with money. They are further subdivided into cash and mutual companies, and are here considered more as examples how money can be made with money, and s0 of peculiar interest to the money-maker, than with a view to special commendation of them, as the most or the least profitable method of so doing. It is rather also to explain their existence as means of saving than of making.

Like banks, insurance companies are usually conducted by superior business men, and upon the same general principles. They have become genuine necessities to all who have property at the risk of the elements, and can not afford to insure themselves—that is, to lose without embarrassment. To the moneymaker they are invaluable, not only as a means of offset against loss, but to make accumulated money gain money. Sometimes the profits of such a business are very large—and at times, too, more frequently than in banking, there is a total loss of the capital invested. It may be said, indeed, that in all business where profits are large, corresponding risks of loss are run. In this branch the chances of gain are greater on marine than on fire insurance, other things being equal.

But the chief benefit of such institutions to the money-maker is that, if his property is in such shape that it can be destroyed by the elements, and it is so

destroyed, wholly or partly, he can cover his loss by the payment annually of a comparatively small sum. Every one, therefore, who is endeavoring to make

money should keep all his endangered property fully insured. An hour’s neglect may lose you many years of toil, as has repeatedly occurred. Take especial care when yon settle’ your agreements with the company’s agent; see that all stipulations are written into the body of the policy, and read it over when completed, with cautious criticism of every point and particular. Observe what you agree, and what they agree, to do. Probably not one-half the policies which are signed and accepted are read over in detail. People presume as of course that they are all right. So they may be; but enough unpleasant surprises and serious losses have resulted from this neglect to put you upon thorough watchfulness in the matter.

If, too, you do not know the officers of a company to be honest and reliable men, with a high standing as such in the community, let it alone; it will probably not pay you in case of loss, if it can get out of it. And if you hear of a company whose” adjuster” is forever chaffering, and screwing and sealing down a loss, and never paying fairly full amounts, especially when a poor man or woman has sustained the loss, have nothing to do with that company; its managers will deal with you so in your day of distress. They have been paid your premiums to pay your loss in full to the extent of your policy, and should do so as cheerfully as they have taken your money. Look more to these than to the capital of the company; but look well to both. Don’t trust your property in the hands of those whom you do not know, personally or by authentic reputation, “down to the ground.” Better pay a fair, reputable company—one that will take pains at once to find out what is your entire loss, and then pay it promptly—a large price at first, than have ten times the sum pared off by a rascally adjuster when your loss occurs. No company, it is true, will undertake this unless steeped in ignorance of its true interests; nor will it retain an official for one moment who tries to save dishonestly on a loss. They lose more by him in the end than do the insured. It is the style in which losses are settled that mainly draws business or repels it. No one forgets the company or the man who does the dishonest thing under such painful circumstances, or the one who deals fairly and uprightly with the misfortune.

The insured may be called upon to take the company’s promise-to-pay for a large amount. Ask yourself, then, Would a bank take their note for this sum, and pay the face of it? Following fully the bank example, you would have to inquire of twelve or fourteen good business men whether they would do so, and trust the company if they would, taking your insurance accordingly.

But on the other hand, the company may be, and often is, subject to fraud by the insured. It is for its interest never to presume fraud without positive proof, at least such proof as would convince a jury. It may better pay, and look next time more carefully to the policy-holder’s character. More money will be made in the long-run by this course. For its own interest, too, there should be no long delay or palaver about the payment of a loss, unless it is intended to contest the case in the courts. A compromise will lose the company more than the sum apparently saved, since one-half of those who hear of it will take for granted that it was an unjust settlement.

The same exercise of civility and pleasant manners, and of interest in the insured, that was recommended to bank officers and employees, is necessary also in the insurance business. All courtesies tell to the profit of the company, the enlargement of its dividends; and in general there is no business in which sound judgments, honest purposes, good reputation, and a fair policy, are rewarded with more promptness and fullness than in this.

Home

Top of Pg.

|

Sennen Cove at Dusk – photo by Jim Champion – 2005 Home Top of Pg. Read more →

Sucker The components of any given market place include both physical structures set up to accommodate trading, and participants to include buyers, sellers, brokers, agents, barkers, pushers, auctioneers, agencies, and propaganda outlets, and banking or transaction exchange facilities. Markets are generally set up by sellers as it is in their [...] Read more →

The following recipes are from a small booklet entitled 500 Delicious Salads that was published for the Culinary Arts Institute in 1940 by Consolidated Book Publishers, Inc. 153 N. Michigan Ave., Chicago, Ill. If you have been looking for a way to lighten up your salads and be free of [...] Read more →

This massive volume gives one a real visual sense of what it was like running a highly efficient colonial operation in the early 20rh Century. It will also go a long way to help anyone wishing to understand modern political intrigue in the Middle-East. Click here to read A Survey of Palestine [...] Read more →

EIGHTEEN GALLONS is here give as a STANDARD for all the following Recipes, it being the most convenient size cask to Families. See A General Process for Making Wine If, however, only half the quantity of Wine is to be made, it is but to divide the portions of [...] Read more →

THE SNIPE, from the Shooter’s Guide by B. Thomas – 1811 AFTER having given a particular description of the woodcock, it will only. be necessary to observe, that the plumage and shape of the snipe is much the same ; and indeed its habits and manners sets bear a great [...] Read more →

Home Top of Pg. Read more →

From the classic British Movie, The Shooting Party, a 1985 British drama film directed by Alan Bridges based on Isabel Colegate’s 9th novel of the same name published in 1980 we find a scene set in the billiards parlor whereupon the host of the weekend shooting party Sir Randolph Nettleby walks in [...] Read more →

Toxicity of Rhododendron From Countrysideinfo.co.UK “Potentially toxic chemicals, particularly ‘free’ phenols, and diterpenes, occur in significant quantities in the tissues of plants of Rhododendron species. Diterpenes, known as grayanotoxins, occur in the leaves, flowers and nectar of Rhododendrons. These differ from species to species. Not all species produce them, although Rhododendron ponticum [...] Read more →

The Apex Building, headquarters of the Federal Trade Commission, on Constitution Avenue and 7th Streets in Washington, D.C.. The building was designed by Edward H. Bennett under the purview of Secretary of the Treasury Andrew W. Mellon, and was completed in 1938 at a cost of $125 million. Photo by Carol M. Highsmith [...] Read more →

Home Top of Pg. Read more →

Today I shall share a bit of market wisdom that will be hard to swallow for some Rolex owners, especially if they bought their Submariner at the top of the magical Covid Watch Bubble that has now collapsed. History often repeats itself, even in the stock market, but when [...] Read more →

Aw, the good old days, meet in the coffee shop with a few friends, click open the Zippo, inhale a glorious nosegay of lighter fluid, fresh roasted coffee and a Marlboro cigarette…. A Meta-analysis of Coffee Drinking, Cigarette Smoking, and the Risk of Parkinson’s Disease We conducted a [...] Read more →

The arsenicals (compounds which contain the heavy metal element arsenic, As) have a long history of use in man – with both benevolent and malevolent intent. The name ‘arsenic’ is derived from the Greek word ‘arsenikon’ which means ‘potent'”. As early as 2000 BC, arsenic trioxide, obtained from smelting copper, was used [...] Read more →

Chipping a Turpentine Tree DISTILLING TURPENTINE One of the Most Important Industries of the State of Georgia Injuring the Magnificent Trees Spirits, Resin, Tar, Pitch, and Crude Turpentine all from the Long Leaved Pine – “Naval Stores” So Called. Dublin, Ga., May 8. – One of the most important industries [...] Read more →

Notes on the intaglio processes of the most expensive book on birds available for sale in the world today. The Audubon prints in “The Birds of America” were all made from copper plates utilizing four of the so called “intaglio” processes, engraving, etching, aquatint, and drypoint. Intaglio [...] Read more →

EBAY’S FRAUD PROBLEM IS GETTING WORSE EBay has had a problem with fraudulent sellers since its inception back in 1995. Some aspects of the platform have improved with algorithms and automation, but others such as customer service and fraud have gotten worse. Small sellers have definitely been hurt by eBay’s [...] Read more →

Home Top of Pg. Read more →

Quite possibly, the most agonizing decision being made by Baby Boomers across the nation these days is what to do with all that vintage Hi-fi equipment and boxes full of classic rock and roll cassettes and 8-Tracks. I faced this dilemma head-on this past summer as I definitely wanted in [...] Read more →

As reported in the The Colac Herald on Friday July 17, 1903 Pg. 8 under Art Appreciation as a reprint from the Westminster Gazette ART APPRECIATION IN THE COMMONS. The appreciation of art as well as of history which is entertained by the average member of the [...] Read more →

The Effect of Magnetic Fields on Wound Healing Experimental Study and Review of the Literature Steven L. Henry, MD, Matthew J. Concannon, MD, and Gloria J. Yee, MD Division of Plastic Surgery, University of Missouri Hospital & Clinics, Columbia, MO Published July 25, 2008 Objective: Magnets [...] Read more →

Home Top of Pg. Read more →

Click here to view Period Furniture Guide Home Top of Pg. Read more →

William Wyggeston’s chantry house, built around 1511, in Leicester: The building housed two priests, who served at a chantry chapel in the nearby St Mary de Castro church. It was sold as a private dwelling after the dissolution of the chantries. A Privately Built Chapel Chantry, chapel, generally within [...] Read more →

Home Top of Pg. Read more →

THE sense of a consecutive tradition has so completely faded out of English art that it has become difficult to realise the meaning of tradition, or the possibility of its ever again reviving; and this state of things is not improved by the fact that it is due to uncertainty of purpose, [...] Read more →

Photo Caption: The Marquis of Zetland, KC, PC – otherwise known as Lawrence Dundas Son of: John Charles Dundas and: Margaret Matilda Talbot born: Friday 16 August 1844 died: Monday 11 March 1929 at Aske Hall Occupation: M.P. for Richmond Viceroy of Ireland Vice Lord Lieutenant of North Yorkshire Lord – in – Waiting [...] Read more →

A General Process for Making Wine. Gathering the Fruit Picking the Fruit Bruising the Fruit Vatting the Fruit Vinous Fermentation Drawing the Must Pressing the Must Casking the Must Spirituous Fermentation Racking the Wine Bottling and Corking the Wine Drinking the Wine GATHERING THE FRUIT. It is of considerable consequence [...] Read more →

Gary Kravit is an airline pilot and artist. He also owns and operates https://theultimatetaboret.com. You may view Gary’s art at https://garrykravitart.blogspot.com/ Home Top of Pg. Read more →

Home Top of Pg. Read more →

Laurens’ portrait as painted during his time spent imprisoned in the Tower of London, where he was kept for over a year after being captured at sea while serving as the United States minister to the Netherlands during the Revolutionary War. The first Christian white man to be cremated in America was [...] Read more →

Nov. 12, 1898 Forest and Stream Pg. 396 The Veterans to the Front. Ironton. O., Oct. 28.—Editor Forest and Stream: I mail you a target made here today by Messrs. E. Lawton, G. Rogers and R. S. Dupuy. Mr. Dupuy is seventy-four years old, Mr. Lawton seventy-two. Mr. Rogers [...] Read more →

The existence of large bodies of men having no other means of subsistence than those afforded by plunder, is, in all countries, too common to excite surprise; and, unhappily, organized bands of assassins are not peculiar to India! The associations of murderers known by the name of Thugs present, however, [...] Read more →

Muscadine Jelly 6 cups muscadine grape juice 6 cups sugar 1 box Kraft Sure Gel or Ball Fruit Jell Home Top of [...] Read more →

Cleremont Club 44 Berkeley Square, London Home Top of Pg. Read more →

Click here to visit Ovation Guitars Ovation Patent Drawing 1975 Click here to read a copy of the 1975 Patent for the Ovation Guitar Home Top of Pg. Read more →

Home Top of Pg. Read more →

Noel Desenfans and Sir Francis Bourgeois, circa 1805 by Paul Sandby, watercolour on paper The Dulwich Picture Gallery was England’s first purpose-built art gallery and considered by some to be England’s first national gallery. Founded by the bequest of Sir Peter Francis Bourgois, dandy, the gallery was built to display his vast [...] Read more →

Fred Kummerow on statin drugs (excerpt) from Jeremy Stuart on Vimeo. Dr. Kummerow passed away at the ripe old age of 102 in 2017. Click here to visit Dr. Mercola’s website. Home Top of Pg. Read more →

A rhetorical question? Genuine concern? In this essay we are examining another form of matter otherwise known as national literary matters, the three most important of which being the Matter of Rome, Matter of France, and the Matter of England. Our focus shall be on the Matter of England or [...] Read more →

Dutch artist Herman de Vries – Photo taken by son Vince The two videos below of Herman de Vries at work at the Venice Bienalle 2015 are quite inspiring. So inspiring in fact that I moved into a cave for two weeks and wrote Shakespearean tragedy with charcoal. Filled with great joy [...] Read more →

Click here to access the Internet Archive of old Popular Mechanics Magazines – 1902-2016 Click here to view old Popular Mechanics Magazine Covers Home Top of Pg. Read more →

Filed under Miscellaneous. The Jubbulpore School of Industry is so thriving that the pupils, 800 in number, are obliged to work till ten o’clock at night to complete their orders; this they do most cheerfully. They are all Thugs, or the children of Thugs, and the hands which now ply [...] Read more →

Salmon and Sturgeon Caviar – Photo by Thor Salmon caviar was originated about 1910 by a fisherman in the Maritime Provinces of Siberia, and the preparation is a modification of the sturgeon caviar method (Cobb 1919). Salomon caviar has found a good market in the U.S.S.R. and other European countries where it [...] Read more →

July 2, 1898 Forest and Stream, Fresh-Water Angling. No. IX.—The Two Crappies. BY FRED MATHER. Fishing In Tree Tops. Here a short rod, say 8ft., is long enough, and the line should not be much longer than the rod. A reel is not [...] Read more →

It was a strange assignment. I picked up the telegram from desk and read it a third time. NEW YORK, N.Y., MAY 9, 1949 HAVE BEEN INVESTIGATING FLYING SAUCER MYSTERY. FIRST TIP HINTED GIGANTIC HOAX TO COVER UP OFFICIAL SECRET. BELIEVE IT MAY HAVE BEEN PLANTED TO HIDE [...] Read more →

THE answer to the question, What is fortune has never been, and probably never will be, satisfactorily made. What may be a fortune for one bears but small proportion to the colossal possessions of another. The scores or hundreds of thousands admired and envied as a fortune in most of our communities [...] Read more →

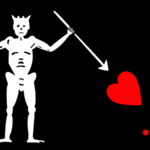

Blackbeard’s Jolly Roger If you’re looking for that most refreshing of summertime beverages for sipping out on the back patio or perhaps as a last drink before walking the plank, let me recommend my Blunderbuss Mai Tai. I picked up the basics to this recipe over thirty years ago when holed up [...] Read more →

Gilbert Stewart – Sir Joshua Reynolds SIR JOSHUA REYNOLDS‘ WORKING COLOURS, WITH THE ORDER IN WHICH THEY WERE ARRANGED ON HIS PALLETTE. “For painting the flesh, black, blue black, white, lake, carmine, orpiment, yellow ochre, ultramarine, and varnish. “To lay the [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

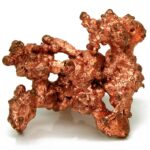

The element copper effectively kills viruses and bacteria. Therefore it would reason and I will assert and not only assert but lay claim to the patents for copper mesh stints to be inserted in the arteries of patients presenting with severe cases of Covid-19 with a slow release dosage of [...] Read more →

WITCHCRAFT, SORCERY, MAGIC AND OTHER PSYCHOLOGICAL PHENOMENA AND THEIR IMPLICATIONS ON MILITARY AND PARAMILITARY OPERATIONS IN THE CONGO This report has been prepared in response to a query posed by ODCS/OPS, Department of the Army, regarding the purported use of witchcraft, sorcery, and magic by insurgent elements in the Republic [...] Read more →

Home Top of Pg. Read more →

? This video by AT Restoration is the best hands on video I have run across on the basics of classic upholstery. Watch a master at work. Simply amazing. Tools: Round needles: https://amzn.to/2S9IhrP Double pointed hand needle: https://amzn.to/3bDmWPp Hand tools: https://amzn.to/2Rytirc Staple gun (for beginner): https://amzn.to/2JZs3x1 Compressor [...] Read more →

Over the years I have observed a decline in manners amongst young men as a general principle and though there is not one particular thing that may be asserted as the causal reason for this, one might speculate… Self-awareness and being aware of one’s surroundings in social [...] Read more →

by John Partridge,drawing,1825 From the work of Sir Charles Lock Eastlake entitled Materials for a history of oil painting, (London: Longman, Brown, Green, and Longmans, 1846), we learn the following: The effect of oil at certain temperatures, in penetrating “the minute pores of the amber” (as Hoffman elsewhere writes), is still more [...] Read more →

Mortlake Tapestries at Chatsworth House Click here to read copy of Daemonologie Home Top of Pg. Read more →

Biograph Theater, where John Dillinger was gunned down by the FBI on July 22, 1934 The Great Depression was on—highway based crime was rampant, the gangsters dressed as well as the bankers they robbed, and and Henry Ford’s big beautiful V8 sedan was the getaway car of choice for both wheelman and [...] Read more →

U.S. SENATE PERMANENT SUBCOMMITTEE ON INVESTIGATIONS STAFF REPORT ON DIVIDEND TAX ABUSE: HOW OFFSHORE ENTITIES DODGE TAXES ON U.S. STOCK DIVIDENDS September 11, 2008 EXECUTIVE SUMMARY Each year, the United States loses an estimated [...] Read more →

Home Top of Pg. Read more →

How happy is he born and taught. That serveth not another’s will; Whose armour is his honest thought, And simple truth his utmost skill Whose passions not his masters are; Whose soul is still prepared for death, Untied unto the world by care Of public fame or private breath; Who envies none that chance [...] Read more →

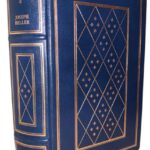

The following highly collectible Franklin Library Signed Editions were published between 1977 and 1982. They are all fully leather bound with beautiful covers and contain gorgeous and rich silk moire endpapers. Signatures are protected by unattached tissue inserts. The values listed are average prices that were sought by [...] Read more →

Edwin Austin Abbey. King Lear, Act I, Scene I (Cordelia’s Farewell) The Metropolitan Museum of Art. Dates: 1897-1898 Dimensions: Height: 137.8 cm (54.25 in.), Width: 323.2 cm (127.24 in.) Medium: Painting – oil on canvas Home Top of Pg. Read more →

Add the following ingredients to a four or six quart crock pot, salt & pepper to taste keeping in mind that salt pork is just that, cover with water and cook on high till it boils, then cut back to low for four or five hours. A slow cooker works well, I [...] Read more →

The greatest cause of failure in vinegar making is carelessness on the part of the operator. Intelligent separation should be made of the process into its various steps from the beginning to end. PRESSING THE JUICE The apples should be clean and ripe. If not clean, undesirable fermentations [...] Read more →

1 garlic clove, cut in half 1 8-oz. pkg. Philadelphia Brand Cream Cheese 3 tablespoons clam broth 1 7-to 7 1/2-oz. can minced clams, drained Home Top of [...] Read more →

Hunters at Work This is a recipe I created from scratch by trial and error. (Note: This recipe contains no eggs, refined white flour or white sugar.) 2 Cups Whole Wheat Flour – As unprocessed as you can find it 3 Cups of Raw Oatmeal 1 Cup of [...] Read more →

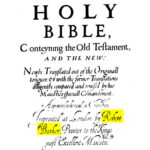

Richard Barker KJ Title Pg. Robert Barker was the printer of the first edition of the King James Bible in 1611. He was the printer to King James I and son of Christopher Barker, printer to Queen Victoria I. Home Top of Pg. Read more →

Paul Thorpe, Brighton, U.K. The YouTube watch collecting world is rather tight-knit and small, but growing, as watches became a highly coveted commodity during the recent world-wide pandemic and fueled an explosion of online watch channels. There is one name many know, The Time Piece Gentleman. This name for me [...] Read more →

Home Top of Pg. Read more →

Liquorice, the roots of Glycirrhiza Glabra, a perennial plant, a native of the south of Europe, but cultivated to some extent in England, particularly at Mitcham, in Surrey. Its root, which is its only valuable part, is long, fibrous, of a yellow colour, and when fresh, very juicy. [...] Read more →

Sebastian Cox is one of the UK’s premier custom furniture makers with a unique background and love for the forest. Click here to visit SebastianCox.co.uk Home Top of Pg. Read more →

Note on Watercolour: F.A. Molony (fl. 1930-1938) was a Major in the Royal Engineers. The National Army Museum hold his work. His work was also shown at an exhibition of officers work at the R.B.A. Galleries (Army Officers’ Art Society) Description from Youtube: June 2015 will see [...] Read more →

Painting the Brooklyn Bridge, Photo by Eugene de Salignac , 1914 Excerpt from: The Preservation of Iron and Steel Structures by F. Cosby-Jones, The Mechanical Engineer January 30, 1914 Painting. This is the method of protection against corrosion that has the most extensive use, owing to the fact that [...] Read more →

Home Top of Pg. Read more →

CLAIRVOYANCE by C. W. Leadbeater Adyar, Madras, India: Theosophical Pub. House [1899] CHAPTER IX – METHODS OF DEVELOPMENT When a men becomes convinced of the reality of the valuable power of clairvoyance, his first question usually is, “How can [...] Read more →

To Choose Poultry. When fresh, the eyes should be clear and not sunken, the feet limp and pliable, stiff dry feet being a sure indication that the bird has not been recently killed; the flesh should be firm and thick and if the bird is plucked there should be no [...] Read more →

Como dome facade – Pliny the Elder – Photo by Wolfgang Sauber Work in Progress… THE VARNISHES. Every substance may be considered as a varnish, which, when applied to the surface of a solid body, gives it a permanent lustre. Drying oil, thickened by exposure to the sun’s heat or [...] Read more →

To learn more about Julian McDonnell, film director, click here. Home Top of Pg. Read more →

If ever it could be said that there is such a thing as miracle healing soil, Ivan Sanderson said it best in his 1965 book entitled Ivan Sanderson’s Book of Great Jungles. Sanderson grew up with a natural inclination towards adventure and learning. He hailed from Scotland but spent much [...] Read more →

Home Top of Pg. Read more →

Gold Home Top of Pg. Read more →

July 9, 1898. Forest and Stream Pg. 25 Some Notes on American Ship-Worms. [Read before the American Fishes Congress at Tampa.] While we wish to preserve and protect most of the products of our waters, these creatures we would gladly obliterate from the realm of living things. For [...] Read more →

Citrus Fruit Culture THE PRINCIPAL fruit and nut trees grown commercially in the United States (except figs, tung, and filberts) are grown as varieties or clonal lines propagated on rootstocks. Almost all the rootstocks are grown from seed. The resulting seedlings then are either budded or grafted with propagating wood [...] Read more →

Click here to access the world’s most powerful Import/Export Research Database on the Planet. With this search engine one is able to access U.S. Customs and other government data showing suppliers for any type of company in the United States. Home Top of Pg. Read more →

Hudson Bay: Trappers, 1892. N’Talking Musquash.’ Fur Trappers Of The Hudson’S Bay Company Talking By A Fire. Engraving After A Drawing By Frederic Remington, 1892. Indian Modes of Hunting. IV.—Musquash. In Canada and the United States, the killing of the little animal known under the several names of [...] Read more →

Home Top of Pg. Read more →

Armorial tablet of the Stewarts – Falkland Palace Fife, Scotland. The Stewart Kings – King James I & VI to Charles II Six video playlist on the Kings of England: Home Top of Pg. Read more →

Robert W. Service (b.1874, d.1958) There are strange things done in the midnight sun By the men who moil for gold; The Arctic trails have their secret tales That would make your blood run cold; The Northern Lights have seen queer sights, But the queerest they ever did see Was that night [...] Read more →

Reprint from the Royal Collection Trust Website The meeting between Henry VIII and Francis I, known as the Field of the Cloth of Gold, took place between 7 to 24 June 1520 in a valley subsequently called the Val d’Or, near Guisnes to the south of Calais. The [...] Read more →

The Chicago portion of the The Great Train Story at the Museum of Science and Industry in Chicago. by Interiority Home Top of Pg. Read more →

Carya Nuts This Handbook is Published by SLMA or the Southeastern Lumber Manufacturer’s Association Click here to read the handbook or click on the link below for a faster download. Hardwood Handbook Home Top of Pg. Read more →

Baking is a very similar process to roasting: the two often do duty for one another. As in all other methods of cookery, the surrounding air may be several degrees hotter than boiling water, but the food is no appreciably hotter until it has lost water by evaporation, after which it may [...] Read more →

Reprint from The Pitfalls of Speculation by Thomas Gibson 1906 Ed. THE PUBLIC ATTITUDE TOWARD SPECULATION THE public attitude toward speculation is generally hostile. Even those who venture frequently are prone to speak discouragingly of speculative possibilities, and to point warningly to the fact that an overwhelming majority [...] Read more →

Take to every quart of water one pound of Malaga raisins, rub and cut the raisins small, and put them to the water, and let them stand ten days, stirring once or twice a day. You may boil the water an hour before you put it to the raisins, and let it [...] Read more →

Full Cover, rear, spine, and front Published by Piranesi Press in collaboration with Country House Essays, this beautiful paperback version of the King James Bible is now available for $79.95 at Barnes and Noble.com This is a limited Edition of 500 copies Worldwide. Click here to view other classic books [...] Read more →

Oct. 22, 1898 Forest and Stream Pg. 324 An Alaskan Moose Head. Tacoma, Washington; Oct. 1.—Editor Forest and Stream: In your issue of March 6, 1897, you showed cut of a pair of moose horns belonging to me that spread 73 1/2 in.— at that time [...] Read more →

Cabildo circa 1936 The Cabildo houses a rare copy of Audubon’s Bird’s of America, a book now valued at $10 million+. Should one desire to visit the Cabildo, click here to gain free entry with a lowcost New Orleans Pass. Home Top of [...] Read more →

Click here to visit Lil’ Lost Lou and purchase a copy of her latest album. Home Top of Pg. Read more →

Click here to purchase a copy of The Trump Bible at Barnes and Noble Home Top of Pg. Read more →

Jul. 30, 1898 Forest and Stream Pg. 87 Indian Mode of Hunting. I.—Beaver. Wa-sa-Kejic came over to the post early one October, and said his boy had cut his foot, and that he had no one to steer his canoe on a proposed beaver hunt. Now [...] Read more →

A Lecture Delivered at the Guildhall, March 2, 1853 by Rev. H.M. Scarth, M.A., Rector of Bathwick. To understand the ancient history of the country in which we live, to know something of the arts and manners of the people who have preceded us, to ascertain what we owe [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

From Dr. Marvel’s 1929 book entitled Hoodoo for the Common Man, we find his infamous Hoochie Coochie Hex. What follows is a verbatim transcription of the text: The Hoochie Coochie Hex should not be used in conjunction with any other Hexes. This can lead to [...] Read more →

http://www.vermeerscamera.co.uk/home.htm Home Top of Pg. Read more →

by Alan Greenspan, 1967 An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense-perhaps more clearly and subtly than many consistent defenders of laissez-faire — that gold and economic freedom are inseparable, that the gold standard is an instrument [...] Read more →

The magician delighted in exposing spiritualists as con men and frauds. By EDMUND WILSON June 24, 1925 Houdini is a short strong stocky man with small feet and a very large head. Seen from the stage, his figure, with its short legs and its pugilist’s proportions, is less impressive than at close [...] Read more →

The following recipes form the most popular items in a nine-course dinner program: BIRD’S NEST SOUP Soak one pound bird’s nest in cold water overnight. Drain the cold water and cook in boiling water. Drain again. Do this twice. Clean the bird’s nest. Be sure [...] Read more →

NEWSPAPER.-Printed sheets published at stated intervals, chiefly for the purpose of conveying intelligence on current events. The Romans wrote out an account of the most memorable occurrences of the day, which were sent to public officials. They were entitled Acta Durna, and read substantially like the local column of a [...] Read more →

Home Top of Pg. Read more →

THE FIRST step in producing a satisfactory crop of tobacco is to use good seed that is true to type. The grower often can save his own seed to advantage, if he wants to. Before topping is done, he should go over the tobacco field carefully to pick [...] Read more →

From The How and When, An Authoritative reference reference guide to the origin, use and classification of the world’s choicest vintages and spirits by Hyman Gale and Gerald F. Marco. The Marco name is of a Chicago family that were involved in all aspects of the liquor business and ran Marco’s Bar [...] Read more →

FRIED SQUIRREL & BISCUIT GRAVY 3-4 Young Squirrels, dressed and cleaned 1 tsp. Morton Salt or to taste 1 tsp. McCormick Black Pepper or to taste 1 Cup Martha White All Purpose Flour 1 Cup Hog Lard – Preferably fresh from hog killing, or barbecue table Cut up three to [...] Read more →

Mudlarks of London Mudlarking along the Thames River foreshore is controlled by the Port of London Authority. According to the Port of London website, two type of permits are issued for those wishing to conduct metal detecting, digging, or searching activities. Standard – allows digging to a depth of 7.5 [...] Read more →

King Leopold Butcher of the Congo For the somewhat startling suggestion in the heading of this interview, the missionary interviewed is in no way responsible. The credit of it, or, if you like, the discredit, belongs entirely to the editor of the Review, who, without dogmatism, wishes to pose the question as [...] Read more →

Country House Essays has returned after a good long summer holiday. More essays soon. Home Top of Pg. Read more →

THE FOWLING PIECE, from the Shooter’s Guide by B. Thomas – 1811. I AM perfectly aware that a large volume might be written on this subject; but, as my intention is to give only such information and instruction as is necessary for the sportsman, I shall forbear introducing any extraneous [...] Read more →

Linseed oil is readily available in many oil painters’ studios. Yardley London Shea Butter Soap can be purchased from a dollar store or pound shop on the cheap. These two ingredients make for the basis of an excellent cleaning system for cleaning oil painting brushes. Home Top of [...] Read more →

Eadweard Muybridge was a fascinating character. Click here to learn how Eadweard committed “Justifiable Homicide” after shooting his wife’s lover in 1874. Home Top of Pg. Read more →

Modern slow cookers come in all sizes and colors with various bells and whistles, including timers and shut off mechanisms. They also come with a serious design flaw, that being the lack of a proper domed lid. The first photo below depict a popular model Crock-Pot® sold far and wide [...] Read more →

THE ABC OF THE FEDERAL RESERVE SYSTEM WH Y THE FEDERAL RESERVE SYSTEM WAS CALLED INTO BEING, THE MAIN FEATURES OF ITS ORGANIZATION , AND HOW IT WORKS B Y EDWIN WALTER KEMMERER, PH.D. PROFESSOR OF ECONOMICS AND FINANCE IN PRINCETON UNIVERSITY AND MEMBER OF [...] Read more →

Absolutely Brilliant! And as I am quite certain you will become a fan, there’s more! Home Top of Pg. Read more →

John Keats Four Seasons fill the measure of the year; There are four seasons in the mind of man: He has his lusty spring, when fancy clear Takes in all beauty with an easy span; He has his Summer, when luxuriously Spring’s honied cud of youthful thoughts he loves To ruminate, and by such [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

. Home Top of [...] Read more →

Over the years I have observed a decline in manners amongst young men as a general principle and though there is not one particular thing that may be asserted as the causal reason for this, one might speculate… Self-awareness and being aware of one’s surroundings in social interactions [...] Read more →

THE HATHA YOGA PRADIPIKA Translated into English by PANCHAM SINH Panini Office, Allahabad [1914] INTRODUCTION. There exists at present a good deal of misconception with regard to the practices of the Haṭha Yoga. People easily believe in the stories told by those who themselves [...] Read more →

Click here to read the Swiss National Bank’s Chronicle of Monetary Events. Home Top of Pg. Read more →

King Arthur, Legends, Myths & Maidens is a massive book of Arthurian legends. This limited edition paperback was just released on Barnes and Noble at a price of $139.00. Although is may seem a bit on the high side, it may prove to be well worth its price as there are only [...] Read more →

Home Top of Pg. Read more →

The Diamond Empire Home Top of [...] Read more →

Home Top of Pg. Read more →

Reprint from The Sportsman’s Cabinet and Town and Country Magazine, Vol I. Dec. 1832, Pg. 94-95 To the Editor of the Cabinet. SIR, Possessing that anxious feeling so common among shooters on the near approach of the 12th of August, I honestly confess I was not able [...] Read more →

TROF. C. F. HOLDFER AND HIS 183LBS. TUNA, WITH BOATMAN JIM GARDNER. July 2, 1898. Forest and Stream Pg. 11 The Tuna Record. Avalon. Santa Catalina Island. Southern California, June 16.—Editor Forest and Stream: Several years ago the writer in articles on the “Game Fishes of the Pacific Slope,” in [...] Read more →

Audubon started to develop a special technique for drawing birds in 1806 a Mill Grove, Pennsylvania. He perfected it during the long river trip from Cincinnati to New Orleans and in New Orleans, 1821. Home Top of [...] Read more →

Tom Oates, aka Nabokov at en.wikipedia No two commercial tuna salads are prepared by exactly the same formula, but they do not show the wide variety characteristic of herring salad. The recipe given here is typical. It is offered, however, only as a guide. The same recipe with minor variations to suit [...] Read more →

Home Top of Pg. Read more →

The Ardabil Carpet – Made in the town of Ardabil in north-west Iran, the burial place of Shaykh Safi al-Din Ardabili, who died in 1334. The Shaykh was a Sufi leader, ancestor of Shah Ismail, founder of the Safavid dynasty (1501-1722). While the exact origins of the carpet are unclear, it’s believed to have [...] Read more →

Buying a book for a serious collector with refined tastes can be a daunting task. However, there is one company that publishes some of the finest reproduction books in the world, books that most collectors wouldn’t mind having in their collection no matter their general preference or specialty. Read more →

BLACKBERRY WINE 5 gallons of blackberries 5 pound bag of sugar Fill a pair of empty five gallon buckets half way with hot soapy water and a ¼ cup of vinegar. Wash thoroughly and rinse. Fill one bucket with two and one half gallons of blackberries and crush with [...] Read more →

It is unnecessary to point out that low-grade fruit may often be used to advantage in the preparation of vinegar. This has always been true in the case of apples and may be true with other fruit, especially grapes. The use of grapes for wine making is an outlet which [...] Read more →

Book Conservators, Mitchell Building, State Library of New South Wales, 29.10.1943, Pix Magazine The following is taken verbatim from a document that appeared several years ago in the Maine State Archives. It seems to have been removed from their website. I happened to have made a physical copy of it at the [...] Read more →

Home Top of [...] Read more →

Here, where these low lush meadows lie, We wandered in the summer weather, When earth and air and arching sky, Blazed grandly, goldenly together. And oft, in that same summertime, We sought and roamed these self-same meadows, When evening brought the curfew chime, And peopled field and fold with shadows. I mind me [...] Read more →

Home Top of Pg. Read more →

Charles Dickens wrote much more than novels. In fact he turned out several very interesting dictionaries to include one of London, one of Paris and one on London’s long meandering river Thames. Click here to read a copy of the Dictionary of the Thames. Home Top of Pg. Read more →

|

Modern slow cookers come in all sizes and colors with various bells and whistles, including timers and shut off mechanisms. They also come with a serious design flaw, that being the lack of a proper domed lid. The first photo below depict a popular model Crock-Pot® sold far and wide [...] Read more →

The magician delighted in exposing spiritualists as con men and frauds. By EDMUND WILSON June 24, 1925 Houdini is a short strong stocky man with small feet and a very large head. Seen from the stage, his figure, with its short legs and its pugilist’s proportions, is less impressive than at close [...] Read more →

Edwin Austin Abbey. King Lear, Act I, Scene I (Cordelia’s Farewell) The Metropolitan Museum of Art. Dates: 1897-1898 Dimensions: Height: 137.8 cm (54.25 in.), Width: 323.2 cm (127.24 in.) Medium: Painting – oil on canvas Home Top of Pg. Read more →

Home Top of Pg. Read more →

Artisans world-wide spend a fortune on commercial brand oil-based gold leaf sizing. The most popular brands include Luco, Dux, and L.A. Gold Leaf. Pricing for quart size containers range from $35 to $55 depending upon retailer pricing. Fast drying sizing sets up in 2-4 hours depending upon environmental conditions, humidity [...] Read more →

Click here to read the Condon Report Home Top of Pg. Read more →

Click here to access the world’s most powerful Import/Export Research Database on the Planet. With this search engine one is able to access U.S. Customs and other government data showing suppliers for any type of company in the United States. Home Top of Pg. Read more →

The Diamond Empire Home Top of [...] Read more →

Home Top of Pg. Read more →

Photo by Rebecca Humann Texas Tea Recipe 2 oz Cuervo Gold Tequila Home Top of [...] Read more →

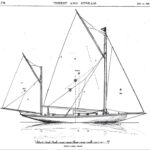

Dec. 10, 1898 Forest and Stream Pg. 477-479 Zulu. The little ship shown in the accompanying plans needs no description, as she speaks for herself, a handsome and shipshape craft that a man may own for years without any fear that she will go to pieces [...] Read more →

Home Top of Pg. Read more →

THE FIRST step in producing a satisfactory crop of tobacco is to use good seed that is true to type. The grower often can save his own seed to advantage, if he wants to. Before topping is done, he should go over the tobacco field carefully to pick [...] Read more →

Mudlarks of London Mudlarking along the Thames River foreshore is controlled by the Port of London Authority. According to the Port of London website, two type of permits are issued for those wishing to conduct metal detecting, digging, or searching activities. Standard – allows digging to a depth of 7.5 [...] Read more →

Roger Scruton – Why Beauty Matters (2009) from Mirza Akdeniz on Vimeo. Click here for another site on which to view this video. Sadly, Sir Roger Scruton passed away a few days ago—January 12th, 2020. Heaven has gained a great philosopher. Home Top of [...] Read more →

Home Top of Pg. Read more →

John Keats Four Seasons fill the measure of the year; There are four seasons in the mind of man: He has his lusty spring, when fancy clear Takes in all beauty with an easy span; He has his Summer, when luxuriously Spring’s honied cud of youthful thoughts he loves To ruminate, and by such [...] Read more →

German made shotguns by Krieghoff, founded in 1886. Home Top of Pg. Read more →

VITRUVIUS The Ten Books on Architecture TRANSLATED By MORRIS HICKY MORGAN, PH.D., LL.D. LATE PROFESSOR OF CLASSICAL PHILOLOGY IN HARVARD UNIVERSITY WITH ILLUSTRATIONS AND ORIGINAL DESINGS PREPARED UNDER THE DIRECTION OF HERBERT LANGFORD WARREN, A.M. NELSON ROBINSON JR. PROFESSOR OF ARCHITECTURE IN HARVARD [...] Read more →

The element copper effectively kills viruses and bacteria. Therefore it would reason and I will assert and not only assert but lay claim to the patents for copper mesh stints to be inserted in the arteries of patients presenting with severe cases of Covid-19 with a slow release dosage of [...] Read more →

Add 3 quarts clover blossoms* to 4 quarts of boiling water removed from heat at point of boil. Let stand for three days. At the end of the third day, drain the juice into another container leaving the blossoms. Add three quarts of fresh water and the peel of one lemon to the blossoms [...] Read more →

From A History of Fowling, Being an Account of the Many Curios Devices by Which Wild Birds are, or Have Been, Captured in Different Parts of the World by Rev. H.A. MacPherson, M.A. THE RAVEN (Corvus corax) is generally accredited with a large endowment of mother wit. Its warning [...] Read more →

“Saint John’s Gate, Clerkenwell, the main gateway to the Priory of Saint John of Jerusalem,” black and white photograph by the British photographer Henry Dixon, 1880. The church was founded in the 12th century by Jordan de Briset, a Norman knight. Prior Docwra completed the gatehouse shown in this photograph in 1504. The gateway [...] Read more →

As reported in the The Colac Herald on Friday July 17, 1903 Pg. 8 under Art Appreciation as a reprint from the Westminster Gazette ART APPRECIATION IN THE COMMONS. The appreciation of art as well as of history which is entertained by the average member of the [...] Read more →

Wojna Kalmarska – 1611 The Kalmar War From The Historian’s History of the World (In 25 Volumes) by Henry Smith William L.L.D. – Vol. XVI.(Scandinavia) Pg. 308-310 The northern part of the Scandinavian peninsula, as already noticed, had been peopled from the remotest times by nomadic tribes called Finns or Cwenas by [...] Read more →

The following highly collectible Franklin Library Signed Editions were published between 1977 and 1982. They are all fully leather bound with beautiful covers and contain gorgeous and rich silk moire endpapers. Signatures are protected by unattached tissue inserts. The values listed are average prices that were sought by [...] Read more →

Home Top of [...] Read more →

July, 16, l898 Forest and Stream Pg. 48 Tuna and Tarpon. New York, July 1.—Editor Forest and Stream: If any angler still denies the justice of my claim, as made in my article in your issue of July 2, that “the tuna is the grandest game [...] Read more →

Crewe Hall Dining Room THE transient tenure that most of us have in our dwellings, and the absorbing nature of the struggle that most of us have to make to win the necessary provisions of life, prevent our encouraging the manufacture of well-wrought furniture. We mean to outgrow [...] Read more →

http://www.vermeerscamera.co.uk/home.htm Home Top of Pg. Read more →

” Here’s many a year to you ! Sportsmen who’ve ridden life straight. Here’s all good cheer to you ! Luck to you early and late. Here’s to the best of you ! You with the blood and the nerve. Here’s to the rest of you ! What of a weak moment’s swerve ? [...] Read more →

CLAIRVOYANCE by C. W. Leadbeater Adyar, Madras, India: Theosophical Pub. House [1899] CHAPTER IX – METHODS OF DEVELOPMENT When a men becomes convinced of the reality of the valuable power of clairvoyance, his first question usually is, “How can [...] Read more →

Sebastian Cox is one of the UK’s premier custom furniture makers with a unique background and love for the forest. Click here to visit SebastianCox.co.uk Home Top of Pg. Read more →

STORE MANAGEMENT—THE SHIRK. THE shirk is a well-known specimen of the genus homo. His habitat is offices, stores, business establishments of all kinds. His habits are familiar to us, but a few words on the subject will not be amiss. The shirk usually displays activity when the boss is around, [...] Read more →

Photo by Greg O’Beirne Home Top of Pg. Read more →

Chipping a Turpentine Tree DISTILLING TURPENTINE One of the Most Important Industries of the State of Georgia Injuring the Magnificent Trees Spirits, Resin, Tar, Pitch, and Crude Turpentine all from the Long Leaved Pine – “Naval Stores” So Called. Dublin, Ga., May 8. – One of the most important industries [...] Read more →

THE HATHA YOGA PRADIPIKA Translated into English by PANCHAM SINH Panini Office, Allahabad [1914] INTRODUCTION. There exists at present a good deal of misconception with regard to the practices of the Haṭha Yoga. People easily believe in the stories told by those who themselves [...] Read more →

Gate of Honour, Caius Court, Gonville & Caius Gonville & Caius College, known as Caius and pronounced keys was founded in 1348 by Edmund Gonville, the Rector of Terrington St Clement in Norfolk. The first name was thus Goville Hall and it was dedicated to the Annunciation of the Blessed Virgin Mary. [...] Read more →

by John Partridge,drawing,1825 From the work of Sir Charles Lock Eastlake entitled Materials for a history of oil painting, (London: Longman, Brown, Green, and Longmans, 1846), we learn the following: The effect of oil at certain temperatures, in penetrating “the minute pores of the amber” (as Hoffman elsewhere writes), is still more [...] Read more →

Kenilworth Abbey Fields – Photo by David Hunt Click here to read Kenilworth by Sir Walter Scott Click here to view Kenilworth Notes Home Top of Pg. Read more →

Richard Barker KJ Title Pg. Robert Barker was the printer of the first edition of the King James Bible in 1611. He was the printer to King James I and son of Christopher Barker, printer to Queen Victoria I. Home Top of Pg. Read more →

Officers and men of the 13th Light Dragoons, British Army, Crimea. Rostrum photograph of photographer’s original print, uncropped and without color correction. Survivors of the Charge. Half a league, half a league, Half a league onward, All in the valley of Death Rode the six hundred. “Forward, the Light Brigade! Charge for the [...] Read more →

Audubon started to develop a special technique for drawing birds in 1806 a Mill Grove, Pennsylvania. He perfected it during the long river trip from Cincinnati to New Orleans and in New Orleans, 1821. Home Top of [...] Read more →

Banana Propagation Reprinted from the International Institute of Tropical Agriculture (IITA.org) The traditional means of obtaining banana planting material (“seed”) is to acquire suckers from one’s own banana garden, from a neighbor, or from a more distant source. This method served to spread common varieties around the world and to multiply them [...] Read more →

Biograph Theater, where John Dillinger was gunned down by the FBI on July 22, 1934 The Great Depression was on—highway based crime was rampant, the gangsters dressed as well as the bankers they robbed, and and Henry Ford’s big beautiful V8 sedan was the getaway car of choice for both wheelman and [...] Read more →

Sept. 3, 1898. Forest and Stream Pg. 188-189 How to Distinguish Fishes. BY FRED MATHER. The average angler knows by sight all the fish which he captures, but ask him to describe one and he is puzzled, and will get off on the color of the fish, which is [...] Read more →

Click here to learn more about The Tallis Scholars Home Top of Pg. Read more →

A la Russie, aux ânes et aux autres – by Chagall – 1911 Marc Chagall is one of the most forged artists on the planet. Mark Rothko fakes also abound. According to available news reports, the art market is littered with forgeries of their work. Some are even thought to be [...] Read more →

Testing the Irish Blue Terrier Breed in 1923. Home Top of Pg. Read more →

KING ARTHUR AND HIS KNIGHTS On the decline of the Roman power, about five centuries after Christ, the countries of Northern Europe were left almost destitute of a national government. Numerous chiefs, more or less powerful, held local sway, as far as each could enforce his dominion, and occasionally those [...] Read more →

From Conquest of the Tropics by Frederick Upham Adams Chapter VI – Birth of the United Fruit Company Only those who have lived in the tropic and are familiar with the hazards which confront the cultivation and marketing of its fruits can readily understand [...] Read more →

Home Top of Pg. Read more →

Click here to access the Internet Archive of old Popular Mechanics Magazines – 1902-2016 Click here to view old Popular Mechanics Magazine Covers Home Top of Pg. Read more →

Reprint from The Pitfalls of Speculation by Thomas Gibson 1906 Ed. THE PUBLIC ATTITUDE TOWARD SPECULATION THE public attitude toward speculation is generally hostile. Even those who venture frequently are prone to speak discouragingly of speculative possibilities, and to point warningly to the fact that an [...] Read more →

Any prudent investor would jump at the chance to receive a guaranteed 6% dividend for life. So how does one get in on this action? The fact of the matter is…YOU can’t…That is unless you are a shareholder of one of the twelve Federal Reserve Banks and the banks under [...] Read more →

Cannone nel castello di Haut-Koenigsbourg, photo by Gita Colmar Without any preliminary cleaning the bronze object to be treated is hung as cathode into the 2 per cent. caustic soda solution and a low amperage direct current is applied. The object is suspended with soft copper wires and is completely immersed into [...] Read more →

Notes on the intaglio processes of the most expensive book on birds available for sale in the world today. The Audubon prints in “The Birds of America” were all made from copper plates utilizing four of the so called “intaglio” processes, engraving, etching, aquatint, and drypoint. Intaglio [...] Read more →

Vintage woodcut illustration of a Eel This dish is a favorite in Northern Europe, from the British Isles to Sweden. Clean and skin the eels and cut them into pieces about 3/4-inch thick. Wash and drain the pieces, then dredge in fine salt and allow to stand from 30 [...] Read more →

Royal Exchange and The Bank of England From How to Make Money; and How to Keep it, Or, Capital and Labor based on the works of Thomas A. Davies Revised & Rewritten with Additions by Henry A. Ford A.M. – 1884 CHAPTER XXVI BANKING AND INSURANCE. I [...] Read more →

Early Texas photo of Tarpon catch – Not necessarily the one mentioned below… July 2, 1898. Forest and Stream Pg.10 Texas Tarpon. Tarpon, Texas.—Mr. W. B. Leach, of Palestine, Texas, caught at Aransas Pass Islet, on June 14, the largest tarpon on record here taken with rod and reel. The [...] Read more →

EBAY’S FRAUD PROBLEM IS GETTING WORSE EBay has had a problem with fraudulent sellers since its inception back in 1995. Some aspects of the platform have improved with algorithms and automation, but others such as customer service and fraud have gotten worse. Small sellers have definitely been hurt by eBay’s [...] Read more →

A terrestial globe on which the tracts and discoveries are laid down from the accurate observations made by Capts Cook, Furneux, Phipps, published 1782 / globe by John Newton ; cartography by William Palmer, held by the State Library of New South Wales The British Library, using sophisticated filming equipment and software, [...] Read more →

Salmon and Sturgeon Caviar – Photo by Thor Salmon caviar was originated about 1910 by a fisherman in the Maritime Provinces of Siberia, and the preparation is a modification of the sturgeon caviar method (Cobb 1919). Salomon caviar has found a good market in the U.S.S.R. and other European countries where it [...] Read more →

Click here to read the full text of the Hunting Act – 2004 Home Top of Pg. Read more →

How happy is he born and taught. That serveth not another’s will; Whose armour is his honest thought, And simple truth his utmost skill Whose passions not his masters are; Whose soul is still prepared for death, Untied unto the world by care Of public fame or private breath; Who envies none that chance [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

The existence of large bodies of men having no other means of subsistence than those afforded by plunder, is, in all countries, too common to excite surprise; and, unhappily, organized bands of assassins are not peculiar to India! The associations of murderers known by the name of Thugs present, however, [...] Read more →

Home Top of Pg. Read more →

San Felipe Model Reprinted from FineModelShips.com with the kind permission of Dr. Michael Czytko The SAN FELIPE is one of the most favoured ships among the ship model builders. The model is elegant, very beautifully designed, and makes a decorative piece of art to be displayed at home or in the [...] Read more →

Mortlake Tapestries at Chatsworth House Click here to read copy of Daemonologie Home Top of Pg. Read more →

“The Leda, in the Colonna palace, by Correggio, is dead-coloured white and black, with ultramarine in the shadow ; and over that is scumbled, thinly and smooth, a warmer tint,—I believe caput mortuum. The lights are mellow ; the shadows blueish, but mellow. The picture is painted on panel, in [...] Read more →

Noel Desenfans and Sir Francis Bourgeois, circa 1805 by Paul Sandby, watercolour on paper The Dulwich Picture Gallery was England’s first purpose-built art gallery and considered by some to be England’s first national gallery. Founded by the bequest of Sir Peter Francis Bourgois, dandy, the gallery was built to display his vast [...] Read more →

H. M. Scarth, Rector of Wrington By the death of Mr. Scarth on the 5th of April, at Tangier, where he had gone for his health’s sake, the familiar form of an old and much valued Member of the Institute has passed away. Harry Mengden Scarth was bron at Staindrop in Durham, [...] Read more →

Here, where these low lush meadows lie, We wandered in the summer weather, When earth and air and arching sky, Blazed grandly, goldenly together. And oft, in that same summertime, We sought and roamed these self-same meadows, When evening brought the curfew chime, And peopled field and fold with shadows. I mind me [...] Read more →

Take the large blue figs when pretty ripe, and steep them in white wine, having made some slits in them, that they may swell and gather in the substance of the wine. Then slice some other figs and let them simmer over a fire in water until they are reduced [...] Read more →

William Wyggeston’s chantry house, built around 1511, in Leicester: The building housed two priests, who served at a chantry chapel in the nearby St Mary de Castro church. It was sold as a private dwelling after the dissolution of the chantries. A Privately Built Chapel Chantry, chapel, generally within [...] Read more →

Snipe shooting-Epistle on snipe shooting, from Ned Copper Cap, Esq., to George Trigger-George Trigger’s reply to Ned Copper Cap-Black partridge. —— “Si sine amore jocisque Nil est jucundum, vivas in &more jooisque.” -Horace. “If nothing appears to you delightful without love and sports, then live in sporta and [...] Read more →

Home Top of Pg. Read more →

This massive volume gives one a real visual sense of what it was like running a highly efficient colonial operation in the early 20rh Century. It will also go a long way to help anyone wishing to understand modern political intrigue in the Middle-East. Click here to read A Survey of Palestine [...] Read more →

Liquorice, the roots of Glycirrhiza Glabra, a perennial plant, a native of the south of Europe, but cultivated to some extent in England, particularly at Mitcham, in Surrey. Its root, which is its only valuable part, is long, fibrous, of a yellow colour, and when fresh, very juicy. [...] Read more →

Citrus Fruit Culture THE PRINCIPAL fruit and nut trees grown commercially in the United States (except figs, tung, and filberts) are grown as varieties or clonal lines propagated on rootstocks. Almost all the rootstocks are grown from seed. The resulting seedlings then are either budded or grafted with propagating wood [...] Read more →

Gary Kravit is an airline pilot and artist. He also owns and operates https://theultimatetaboret.com. You may view Gary’s art at https://garrykravitart.blogspot.com/ Home Top of Pg. Read more →

Robert W. Service (b.1874, d.1958) There are strange things done in the midnight sun By the men who moil for gold; The Arctic trails have their secret tales That would make your blood run cold; The Northern Lights have seen queer sights, But the queerest they ever did see Was that night [...] Read more →

Click here to visit Ovation Guitars Ovation Patent Drawing 1975 Click here to read a copy of the 1975 Patent for the Ovation Guitar Home Top of Pg. Read more →

The greatest cause of failure in vinegar making is carelessness on the part of the operator. Intelligent separation should be made of the process into its various steps from the beginning to end. PRESSING THE JUICE The apples should be clean and ripe. If not clean, undesirable fermentations [...] Read more →

Home Top of Pg. Read more →

Bess of Harwick Four times the nuptial bed she warm’d, And every time so well perform’d, That when death spoil’d each husband’s billing, He left the widow every shilling. Fond was the dame, but not dejected; Five stately mansions she erected With more than royal pomp, to vary The prison of her captive When [...] Read more →

Home Top of Pg. Read more →

Blackbeard’s Jolly Roger If you’re looking for that most refreshing of summertime beverages for sipping out on the back patio or perhaps as a last drink before walking the plank, let me recommend my Blunderbuss Mai Tai. I picked up the basics to this recipe over thirty years ago when holed up [...] Read more →

Home Top of Pg. Read more →

Click here to view more great Italian recipes. Home Top of Pg. Read more →

Home Top of [...] Read more →

Patek Phillipe hand makes the finest watches in the world. Click here to learn more. Home Top of Pg. Read more →

Home Top of Pg. Read more →

Take to every quart of water one pound of Malaga raisins, rub and cut the raisins small, and put them to the water, and let them stand ten days, stirring once or twice a day. You may boil the water an hour before you put it to the raisins, and let it [...] Read more →

Home Top of Pg. Read more →

WIPO HQ Geneva UNITED STATES PLANT VARIETY PROTECTION ACT TITLE I – PLANT VARIETY PROTECTION OFFICE Chapter Section 1. Organization and Publications . 1 2. Legal Provisions as to the Plant Variety Protection Office . 21 3. Plant Variety Protection Fees . 31 CHAPTER 1.-ORGANIZATION AND PUBLICATIONS Section [...] Read more →

AB Bookman’s 1948 Guide to Describing Conditions: As New is self-explanatory. It means that the book is in the state that it should have been in when it left the publisher. This is the equivalent of Mint condition in numismatics. Fine (F or FN) is As New but allowing for the normal effects of [...] Read more →

The downloadable audio clip is of FDR’s Second Fireside Chat recorded on May 7th, 1933. FDR 2nd Fireside Chat - May 7, 1933 - 18.5MB The transcript that follows is my corrected version of the transcript that is found The American Presidency Project website that was created [...] Read more →