The Stock Exchange Specialist March 30th, 2019  New York Stock Exchange Floor September 26,1963 The Specialist as a member of a stock exchange has two functions.’ He must execute orders which other members of an exchange may leave with him when the current market price is away from the price of the orders. By executing these orders on behalf of the other exchange members when the market price reaches the price stated on these orders, the specialist makes it possible for these members to perform their business elsewhere on the Floor. In handling these orders, the specialist acts as broker or agent. In addition to the brokerage functions, however, he has historically had the additional function of acting as dealer or principal for his own account. Under current rules and regulations of the exchanges and the Securities and Exchange Commission, purchases and sales for his own account must be made, insofar as reasonably practicable, with a view to assuring a fair and orderly market in the stocks which he services. Moreover, whenever there are public buyers but no public sellers, or public sellers but no public buyers, he is expected, within reasonable limits, to buy or sell for his own account in order to decrease price differences between transactions and to add depth to the market. He performs both functions for a limited number of issues assigned to him by the stock exchange.

HISTORICAL OVERVIEW

In 1935 the Twentieth Century Fund’s study of the securities market concluded that: Specialists, as well as other exchange members, should be permitted to function either as traders or as brokers, but not as both. . . .No specialist, or other broker, should be permitted to have any interest in any trading account, pool, syndicate, underwriting operation or option!

The Fund’s basis for this conclusion was its belief that “the services rendered by the specialist are not of sufficient value to warrant the continuation of a condition where a small group of persons is given a preferred position in the market.”

One year later the Securities and Exchange Commission in studying the same system reached the conclusion that insufficient data had been presented to justify the segregation of functions.’ In 1941 Professor Vernon, then a member of the Commission staff, suggested an alternative to considering the specialist in terms of his general beneficial or detrimental effect on the market as both the Twentieth Century Fund and Segregation Report had done. He stated that the feasibility of regulating the specialist should be viewed in terms giving recognition to the possibility that his job may vary in different types of stocks . . . .The dealer role of specialists may be necessary and justifiable for one set of stocks, providing sufficient grounds for overlooking his advantage over the public as a dealer in such issues, while his dealer position in another group of stocks runs contrary to the public interest In actively traded issues where a sufficient number of buyers and sellers exists to assure a continuous market with each sale price related to the prior sale, Vernon reasoned, little justification for the specialist function exists. He recognized the need for greater study to effectively develop such segmented rules regulating the specialist’s activity.

Little was written on the specialist system in the exhaustive manner of the Twentieth Century Fund, the Segregation Report, and Vernon’s book until 1963 when the Commission’s Special Study reported that “in its present form, [the specialist system] appears to be an essential mechanism for maintaining continuous auction markets and, in broad terms, appears to be serving its purposes satisfactorily.”‘ With the adoption of rule 1 lb-110 which recognized both the dealer and broker functions of the specialist, the issue seemed finally settled, at least from a legal standpoint, that the specialist system’s beneficial effects surpassed any defects.

ECONOMIC ROLE OF THE SPECIALIST

Several important questions should be examined to acquire an understanding of the economic motivations -present in the specialist system and of the impact of the specialist on market prices. To what extent is the specialist’s monopolistic, or oligopolistic power to administer the price of his specialty stock limited by his obligation to maintain a fair and orderly market? Can a specialist be a speculator and still meet this obligation? What do the terms “fair market” and “orderly market” mean?

In any economic categorization of the specialist’s function, the specialist’s position as the price administrator of his specialty stock requires analysis. To the extent that he is a sole” price administrator, he may be considered a monopolist Professor Baumol comments that “the specialist must be treated not as a competitor, but, on the contrary (at least for a narrow ‘normal’ price range) as a price administering monopolist or oligopolist.”‘ In part his conclusion depends on the assertion that the specialist knows the demand and supply curves through his “book” and can “choose to end up at the spot which is most favorable to him from among all the points that constitute the market’s offer curve.”‘

Any economic analysis of the specialist’s role must also consider the obligations of the specialist both under the securities laws and the applicable rules of the stock exchanges. While economic theory is practically limited by the specialist’s legal obligation, that theory should be influential in interpreting or formulating particular rules within the legal framework. Since obligations may differ as the time period is lengthened, the specialist’s economic role can be classified into three time periods: short, intermediate, and long run. The unique nature of the specialist’s function suggests a fourth classification-sudden price fluctuations.

While the latter category generally occurs within the short run, it warrants special attention because it involves unique legal and economic considerations.

Short Run

The primary emphasis on the role of the specialist has always been on his short run” value to the market.6 He is obligated to reduce temporary disparities between supply and demand in order to facilitate a fair and orderly market. However, the meaning of “temporary disparities” is unclear, since the time duration of the specialist’s short run obligation may depend upon the particular facts of the situation. Arguably, in certain instances, his obligation may be for only a few hours or less if his economic capability as a dealer is threatened by a deluge of orders. Thus the specialist’s obligation to maintain a fair and orderly market is limited in the sense that no one expects him to go bankrupt performing his daily duties. His monopolist’s or oligopolist’s role is further limited since the direction in which he is obligated to administer the price of his specialty stock is against the market trend.

To evaluate the specialist’s performance the NYSE uses the “tick test” to determine if he is acting to maintain a fair and orderly market. By this test, specialist purchases below and sales above the last different price are deemed stablizing and therefore proper.”

The specialist has a certain amount of discretion in exercising his short run obligation. In some situations, he has no choice but to enter the market as dealer and consequently is obliged to be a price administrator.

Other situations, however, do not necessarily require his entry into the market nor do they foreclose his participation. For example, if the highest bid on the “book” is for 100 shares at 20 and the lowest public offer is at 20 3/8, the specialist might in certain cases have discretion to either place his own bid or withhold himself from the market. If the situation were changed so that the lowest offer was at 24, making the spread four points, the specialist would be obliged to enter the market as dealer. In this instance he would be required to administer the price of the stock. But depending on numerous considerations including the last sale price of the stock, competition from both regional stock exchanges and the third market, and volatility of the stock, he has a certain amount of discretion in determining how to enter the market-as a bidder, offeror, or both-and at what price. Hence, even when he is under an obligation to administer the price of the stock, the manner in which he exercises this obligation is somewhat discretionary so long as his action ultimately promotes a fair and orderly market.

It should be noted that while many monopolists and oligopolists are regulated as to the price they may charge, the specialist, because of the very nature of the “free market'” could not be so regulated.

In considering the specialist’s short run value to the market, a problem arises in determining when “temporary disparities between supply and demand” cease to be temporary. The answer arguably appears after the situation has occurred, making the short run obligation as nebulous as the actions of market prices themselves.

Sudden Price Changes

The possibility of sudden large shifts in market prices provides a major justification for the specialist’s existence.

The shift may result on an individual stock-by-stock basis due to a public announcement by management or from a sudden rise or decline in the general market. While suspension of trading in the specialist’s stock or in all stocks will release the specialist from his obligation, 9 a considerable economic dislocation will undoubtedly occur between the influx of orders and the eventual suspension of trading. In the interim the specialist is expected to add depth and liquidity to a market which would otherwise be devoid of these characteristics. In two previous sharp declines specialists have been net purchasers, but their participation probably depended not only upon their obligation but upon their economic outlook. Although specialists were net buyers immediately after President Eisenhower’s heart attack and during the sharp market decline of May 28, 1962, their stabilization effect on these two occasions differed greatly.

According to the Special Study, one reason for the lack of substantial purchases by the specialists on May 28 was their belief that this decline was non-temporary in nature!’ The stabilizing effect of the specialists on May 28 was widely publicized by the NYSE, implying that at least the Exchange felt that most specialists had met their obligations n The emphasis placed on net purchases by both the NYSE and the Special Study indicates that the characterization of the specialist as a stabilizing monopolist or oligopolist definitely includes the daily periods of sudden price movement. The extent to which the specialist must meet this obligation is difficult to determine; numerous factors including his capital status must be considered. The Special Study commented; “Obviously, no one person has the capital to stem a selling wave such as that of May 28, but with his central location, the specialist is in a position to cushion the public’s selling by giving depth to the markets.

The Intermediate and Long Run

The specialist’s obligation to stabilize the market is reduced as the long run is approached. Indeed, if such an obligation exists in the long run, the auction market would be a manipulated, rather than a free, market. The terms used to describe the specialist’s function-“fair and orderly market;” “temporary disparities between supply and demand;” “liquidity and continuity,—as well as the “tick test” and the limited capital requirement of the specialist place emphasis on the specialist’s economic role over the short run.

Regardless of the duration of the specialist’s obligation, economic .analysis of the specialist’s role must necessarily consider Congress’ two basic aims that the stock market be “fair” and “orderly.”‘

Professor Vernon commented:

- A “fair” market . . . bears the connotation of a market in ,which the individual investor need not fear for the integrity of his broker, the safety of his funds, or the possibility that price movements are being artificially controlled.

- An “orderly” market is regarded as one in which there are no “sudden and unreasonable fluctuations in the prices of securities” and consequently a market which makes no unnecessary adverse contribution to the stability and well-being of the public at large. The two major functions of regulation, therefore, are carefully distinguished; the goal of fairness, directed primarily at the protection of the individual, may be looked upon as something in the nature of a police function, while the “orderly market” aim, an aim intended to benefit the general public interest, is more suggestive of the use by Government of economic controls.

Clearly, [orderly market] was intended in some way to represent a market which was free from “excessive speculation,” a type of speculation which, we are told, results “in sudden and unreasonable fluctuations in the prices of securities.”

No agreement exists concerning the effect of speculation on stock prices. Under one theory, the speculator stabilizes prices by purchasing or selling as necessary to move prices toward an equilibrium position. A contrary theory assumes that the speculator will continue to follow trends past the equilibrium. Under the latter hypothesis the mere presence of traders in the market can accentuate, rather than dampen, fluctuations.2 Thus generalities are not possible.

Not all speculators follow, or in the case of specialists, should be permitted to follow, a destabilizing pattern. The “bad” speculator aggravates price trends by going with the trend; the “good” speculator goes against the trend, thereby adding stability to the market. The “bad” speculator may have prompted Congress’ adoption of the “orderly market” standard. To the extent that the specialist is not permitted to buy or sell except to promote a fair and orderly market, he is prevented, at least on a trade-by-trade basis, from being a “bad” speculator. Thus, the scope of his obligation under the applicable rules of his exchange and the obligation imposed by the 1934 Act and Commission rules thereunder are of importance in limiting instability due to speculation?

Some economists, including Professor Stigler, believe that the specialist’s ability to “predict changes in equilibrium prices, or, in other words, how closely does he keep bid and ask prices to the levels which in retrospect were correct” should be a criterion for judging his efficiency. To the extent specialists are able to estimate the future course of events they would “smooth the path of the price quotations. Hence, the specialist’s own profit motive as a speculator, rather than any imposed obligation, would enable him to perform his economic and legal roles. Stigler further criticized the suspension of trading in a stock in an emergency situation, believing that the mechanics of speculation would work as effectively here as in a normal market.

Some disagreed with Stigler’s approach. Considering the proposed standard of market efficiency-the success of the speculator in judging changes in equilibrium prices-commentators argued that Stigler implicitly assumes that speculators do not affect equilibrium price, so that the existence of speculative profits is necessarily a reflection of the success of speculators in anticipating movements in equilibrium price . . . .This is a basic assumption . . . without justification . . . .There are both theoretical and empirical grounds for believing that the demand schedule of investors in the stock market is greatly influenced by price movements, so that speculators can profit substantially by trading actively which is destabilizing. For example, if speculators make heavy net purchases of a security in a period when its equilibrium price has risen moderately as a result of favorable financial news, their activity may drive the price much higher than it would otherwise have gone 3

Replying to this criticism, Stigler stated that he did consider the effect of the speculator’s activity by assuming “that the speculator’s balances are equal at the beginning and at the end of a speculative interval.”” The rebuttal to Stigler’s reply concluded that Stigler’s economic model “assumes that the equilibrium price of investors is not affected by price movements or by the speculator’s effects on such liquidity of the auction market in which specialists play a pivotal role. In this connection, they are considering an increased role for block positioning firms with specialists. In that case, the specialist rules which evolved to fit the needs of individuals may have to undergo profound changes to satisfy the new situation and the increasing role

of block positioners. Even if the exchanges succeed in their efforts to bring and keep blocks on the floor of the exchange, the changes in structure due to the growth of blocks may result in the growth of a situation which many feel currently exists-that is, two de facto separate markets, a negotiated market for blocks and the traditional specialist auction market for individuals.movements,” notwithstanding Stigler’s contrary assertion. Reference was again made to the substantial evidence indicating that the speculator could indeed aggravate price movements and thereby be destabilizing.

Reprint of The Stock Exchange Specialist: An Economic and Legal Analysis, by Nicholas Wolfson and Thomas A. Russo

to read full copy with footnotes and sources.

Click here to learn how the Specialist system works in today’s modern markets.

Home

Top of Pg.

|

Snipe shooting-Epistle on snipe shooting, from Ned Copper Cap, Esq., to George Trigger-George Trigger’s reply to Ned Copper Cap-Black partridge. —— “Si sine amore jocisque Nil est jucundum, vivas in &more jooisque.” -Horace. “If nothing appears to you delightful without love and sports, then live in sporta and [...] Read more →

From Conquest of the Tropics by Frederick Upham Adams Chapter VI – Birth of the United Fruit Company Only those who have lived in the tropic and are familiar with the hazards which confront the cultivation and marketing of its fruits can readily understand [...] Read more →

ORIGIN OF THE APOTHECARY. The origin of the apothecary in England dates much further back than one would suppose from what your correspondent, “A Barrister-at-Law,” says about it. It is true he speaks only of apothecaries as a distinct branch of the medical profession, but long before Henry VIII’s time [...] Read more →

King Leopold Butcher of the Congo For the somewhat startling suggestion in the heading of this interview, the missionary interviewed is in no way responsible. The credit of it, or, if you like, the discredit, belongs entirely to the editor of the Review, who, without dogmatism, wishes to pose the question as [...] Read more →

Oh Glorious England, verdant fields and wandering canals… In this wonderful series of videos, the CountryHouseGent takes the viewer along as he chugs up and down the many canals crisscrossing England in his classic Narrowboat. There is nothing like a free man charting his own destiny. Read more →

Aw, the good old days, meet in the coffee shop with a few friends, click open the Zippo, inhale a glorious nosegay of lighter fluid, fresh roasted coffee and a Marlboro cigarette…. A Meta-analysis of Coffee Drinking, Cigarette Smoking, and the Risk of Parkinson’s Disease We conducted a [...] Read more →

Fed Chariman William McChesney Martin – 1952-1970 [Editor note: This response in my mind is quite hilarious…and to the point…who the heck would want to give up 6% interest year after year after year after year? ] You HAVE ASKED that I appear before you today in connection with your consideration [...] Read more →

Kenilworth Abbey Fields – Photo by David Hunt Click here to read Kenilworth by Sir Walter Scott Click here to view Kenilworth Notes Home Top of Pg. Read more →

King Arthur, Legends, Myths & Maidens is a massive book of Arthurian legends. This limited edition paperback was just released on Barnes and Noble at a price of $139.00. Although is may seem a bit on the high side, it may prove to be well worth its price as there are only [...] Read more →

Add the following ingredients to a four or six quart crock pot, salt & pepper to taste keeping in mind that salt pork is just that, cover with water and cook on high till it boils, then cut back to low for four or five hours. A slow cooker works well, I [...] Read more →

Over the years I have observed a decline in manners amongst young men as a general principle and though there is not one particular thing that may be asserted as the causal reason for this, one might speculate… Self-awareness and being aware of one’s surroundings in social interactions [...] Read more →

NEWSPAPER.-Printed sheets published at stated intervals, chiefly for the purpose of conveying intelligence on current events. The Romans wrote out an account of the most memorable occurrences of the day, which were sent to public officials. They were entitled Acta Durna, and read substantially like the local column of a [...] Read more →

The existence of large bodies of men having no other means of subsistence than those afforded by plunder, is, in all countries, too common to excite surprise; and, unhappily, organized bands of assassins are not peculiar to India! The associations of murderers known by the name of Thugs present, however, [...] Read more →

Fred Kummerow on statin drugs (excerpt) from Jeremy Stuart on Vimeo. Dr. Kummerow passed away at the ripe old age of 102 in 2017. Click here to visit Dr. Mercola’s website. Home Top of Pg. Read more →

DECORATED or “sumptuous” furniture is not merely furniture that is expensive to buy, but that which has been elaborated with much thought, knowledge, and skill. Such furniture cannot be cheap, certainly, but the real cost of it is sometimes borne by the artist who produces rather than by the man who may [...] Read more →

Charles Dickens wrote much more than novels. In fact he turned out several very interesting dictionaries to include one of London, one of Paris and one on London’s long meandering river Thames. Click here to read a copy of the Dictionary of the Thames. Home Top of Pg. Read more →

To Clean Watch Chains. Gold or silver watch chains can be cleaned with a very excellent result, no matter whether they may be matt or polished, by laying them for a few seconds in pure aqua ammonia; they are then rinsed in alcohol, and finally. shaken in clean sawdust, free from sand. [...] Read more →

Home Top of Pg. Read more →

Click here to visit Lil’ Lost Lou and purchase a copy of her latest album. Home Top of Pg. Read more →

Home Top of Pg. Read more →

A rhetorical question? Genuine concern? In this essay we are examining another form of matter otherwise known as national literary matters, the three most important of which being the Matter of Rome, Matter of France, and the Matter of England. Our focus shall be on the Matter of England or [...] Read more →

Note on Watercolour: F.A. Molony (fl. 1930-1938) was a Major in the Royal Engineers. The National Army Museum hold his work. His work was also shown at an exhibition of officers work at the R.B.A. Galleries (Army Officers’ Art Society) Description from Youtube: June 2015 will see [...] Read more →

Jul. 30, 1898 Forest and Stream Pg. 87 Indian Mode of Hunting. I.—Beaver. Wa-sa-Kejic came over to the post early one October, and said his boy had cut his foot, and that he had no one to steer his canoe on a proposed beaver hunt. Now [...] Read more →

Home Top of Pg. Read more →

Aug. 13, 1898 Forest and Stream, Pg. 125 Game Bag and Gun. Indian Modes of Hunting. III.—Foxes. The fox as a rule is a most wily animal, and numerous are the stories of his cunning toward the Indian hunter with his steel traps. Read more →

Foie gras with Sauternes, Photo by Laurent Espitallier As an Appetizer Pale dry Sherry, with or without bitters, chilled or not. Plain or mixed Vermouth, with or without bitters. A dry cocktail. With Oysters, Clams or Caviar A dry flinty wine such as Chablis, Moselle, Champagne. Home Top of [...] Read more →

This massive volume gives one a real visual sense of what it was like running a highly efficient colonial operation in the early 20rh Century. It will also go a long way to help anyone wishing to understand modern political intrigue in the Middle-East. Click here to read A Survey of Palestine [...] Read more →

If a Woman asks you to Change, Politely Excuse Yourself and Walk out the Door; Forever Nobody changes; character is built early in life, and by the time one is involved in adult relationships, it is highly unlikely that one can rebuild one’s character. Recognizing this early on in ones adult [...] Read more →

Home Top of Pg. Read more →

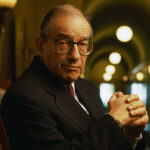

by Alan Greenspan, 1967 An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense-perhaps more clearly and subtly than many consistent defenders of laissez-faire — that gold and economic freedom are inseparable, that the gold standard is an instrument [...] Read more →

Home Top of [...] Read more →

WITCHCRAFT, SORCERY, MAGIC AND OTHER PSYCHOLOGICAL PHENOMENA AND THEIR IMPLICATIONS ON MILITARY AND PARAMILITARY OPERATIONS IN THE CONGO This report has been prepared in response to a query posed by ODCS/OPS, Department of the Army, regarding the purported use of witchcraft, sorcery, and magic by insurgent elements in the Republic [...] Read more →

Donate to the YouTube site owner Gabe and he might send you some chocolate…. Home Top of Pg. Read more →

? This video by AT Restoration is the best hands on video I have run across on the basics of classic upholstery. Watch a master at work. Simply amazing. Tools: Round needles: https://amzn.to/2S9IhrP Double pointed hand needle: https://amzn.to/3bDmWPp Hand tools: https://amzn.to/2Rytirc Staple gun (for beginner): https://amzn.to/2JZs3x1 Compressor [...] Read more →

Testing the Irish Blue Terrier Breed in 1923. Home Top of Pg. Read more →

Home Top of Pg. Read more →

July 2, 1898 Forest and Stream, Fresh-Water Angling. No. IX.—The Two Crappies. BY FRED MATHER. Fishing In Tree Tops. Here a short rod, say 8ft., is long enough, and the line should not be much longer than the rod. A reel is not [...] Read more →

VITRUVIUS The Ten Books on Architecture TRANSLATED By MORRIS HICKY MORGAN, PH.D., LL.D. LATE PROFESSOR OF CLASSICAL PHILOLOGY IN HARVARD UNIVERSITY WITH ILLUSTRATIONS AND ORIGINAL DESINGS PREPARED UNDER THE DIRECTION OF HERBERT LANGFORD WARREN, A.M. NELSON ROBINSON JR. PROFESSOR OF ARCHITECTURE IN HARVARD [...] Read more →

In July of 1968, the National Aeronautics and Space Administration(NASA), published NASA Technical Report TR R-277 titled Chronological Catalog of Recorded Lunar Events. The catalog begins with the first entry dated November 26th, 1540 at ∼05h 00m: Feature: Region of Calippus2 Description: Starlike appearance on dark side Observer: Observers at Worms Reference: [...] Read more →

Stoke Park Pavillions Stoke Park Pavilions, UK, view from A405 Road. photo by Wikipedia user Cj1340 From Wikipedia: Stoke Park – the original house Stoke park was the first English country house to display a Palladian plan: a central house with balancing pavilions linked by colonnades or [...] Read more →

The following are transcripts of two letters written by the Founding Father Thomas Jefferson on the subject of seed saving. “November 27, 1818. Monticello. Thomas Jefferson to Henry E. Watkins, transmitting succory seed and outlining the culture of succory.” [Transcript] Thomas Jefferson Correspondence Collection Collection 89 Read more →

First Pineapple Grown in England Click here to read an excellent article on the history of pineapple growing in the UK. Should one be interested in serious mass scale production, click here for scientific resources. Growing pineapples in the UK. The video below demonstrates how to grow pineapples in Florida. [...] Read more →

It was a strange assignment. I picked up the telegram from desk and read it a third time. NEW YORK, N.Y., MAY 9, 1949 HAVE BEEN INVESTIGATING FLYING SAUCER MYSTERY. FIRST TIP HINTED GIGANTIC HOAX TO COVER UP OFFICIAL SECRET. BELIEVE IT MAY HAVE BEEN PLANTED TO HIDE [...] Read more →

EIGHTEEN GALLONS is here give as a STANDARD for all the following Recipes, it being the most convenient size cask to Families. See A General Process for Making Wine If, however, only half the quantity of Wine is to be made, it is but to divide the portions of [...] Read more →

The downloadable audio clip is of FDR’s Second Fireside Chat recorded on May 7th, 1933. FDR 2nd Fireside Chat - May 7, 1933 - 18.5MB The transcript that follows is my corrected version of the transcript that is found The American Presidency Project website that was created [...] Read more →

Reprint from The Royal Collection Trust website: Kneller was born in Lubeck, studied with Rembrandt in Amsterdam and by 1676 was working in England as a fashionable portrait painter. He painted seven British monarchs (Charles II, James II, William III, Mary II, Anne, George I and George II), though his [...] Read more →

Gold Home Top of Pg. Read more →

Cannone nel castello di Haut-Koenigsbourg, photo by Gita Colmar Without any preliminary cleaning the bronze object to be treated is hung as cathode into the 2 per cent. caustic soda solution and a low amperage direct current is applied. The object is suspended with soft copper wires and is completely immersed into [...] Read more →

Click here to read the full text of the Hunting Act – 2004 Home Top of Pg. Read more →

Wine Making Grapes are the world’s leading fruit crop and the eighth most important food crop in the world, exceeded only by the principal cereals and starchytubers. Though substantial quantities are used for fresh fruit, raisins, juice and preserves, most of the world’s annual production of about 60 million [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

Hunters at Work This is a recipe I created from scratch by trial and error. (Note: This recipe contains no eggs, refined white flour or white sugar.) 2 Cups Whole Wheat Flour – As unprocessed as you can find it 3 Cups of Raw Oatmeal 1 Cup of [...] Read more →

Add 3 quarts clover blossoms* to 4 quarts of boiling water removed from heat at point of boil. Let stand for three days. At the end of the third day, drain the juice into another container leaving the blossoms. Add three quarts of fresh water and the peel of one lemon to the blossoms [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

Reprint from The Pitfalls of Speculation by Thomas Gibson 1906 Ed. THE PUBLIC ATTITUDE TOWARD SPECULATION THE public attitude toward speculation is generally hostile. Even those who venture frequently are prone to speak discouragingly of speculative possibilities, and to point warningly to the fact that an [...] Read more →

Home Top of Pg. Read more →

Dr. David Starkey, the UK’s premiere historian, speaks to the modern and fleeting notion of “cancel culture”. Starkey’s brilliance is unparalleled and it has become quite obvious to the world’s remaining Western scholars willing to stand on intellectual integrity that a few so-called “Woke Intellectuals” most certainly cannot undermine [...] Read more →

A la Russie, aux ânes et aux autres – by Chagall – 1911 Marc Chagall is one of the most forged artists on the planet. Mark Rothko fakes also abound. According to available news reports, the art market is littered with forgeries of their work. Some are even thought to be [...] Read more →

Over the years I have observed a decline in manners amongst young men as a general principle and though there is not one particular thing that may be asserted as the causal reason for this, one might speculate… Self-awareness and being aware of one’s surroundings in social [...] Read more →

THE sense of a consecutive tradition has so completely faded out of English art that it has become difficult to realise the meaning of tradition, or the possibility of its ever again reviving; and this state of things is not improved by the fact that it is due to uncertainty of purpose, [...] Read more →

King George IV was known far and wide as the dandy king, incompetent, ugly, and vulgar. As Prince regent, prior to his assent to the throne, he kept fast company with Beau Brummel, King of Dandies, a man sixteen years his younger. And decadence followed. King George was a gambler, philanderer, and [...] Read more →

Gate of Honour, Caius Court, Gonville & Caius Gonville & Caius College, known as Caius and pronounced keys was founded in 1348 by Edmund Gonville, the Rector of Terrington St Clement in Norfolk. The first name was thus Goville Hall and it was dedicated to the Annunciation of the Blessed Virgin Mary. [...] Read more →

Dried Norwegian Salt Cod Fried fish cakes are sold rather widely in delicatessens and at prepared food counters of department stores in the Atlantic coastal area. This product has possibilities for other sections of the country. Ingredients: Home Top of [...] Read more →

The Apex Building, headquarters of the Federal Trade Commission, on Constitution Avenue and 7th Streets in Washington, D.C.. The building was designed by Edward H. Bennett under the purview of Secretary of the Treasury Andrew W. Mellon, and was completed in 1938 at a cost of $125 million. Photo by Carol M. Highsmith [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

Biograph Theater, where John Dillinger was gunned down by the FBI on July 22, 1934 The Great Depression was on—highway based crime was rampant, the gangsters dressed as well as the bankers they robbed, and and Henry Ford’s big beautiful V8 sedan was the getaway car of choice for both wheelman and [...] Read more →

Home Top of Pg. Read more →

St.Helen’s on the Thames, photo by Momit From a Dictionary of the Thames from Oxford to the Nore. 1880 by Charles Dickens Abingdon, Berkshire, on the right bank, from London 103 3/4miles, from Oxford 7 3/4 miles. A station on the Great Western Railway, from Paddington 60 miles. The time occupied [...] Read more →

Click here to visit Ovation Guitars Ovation Patent Drawing 1975 Click here to read a copy of the 1975 Patent for the Ovation Guitar Home Top of Pg. Read more →

The following recipes form the most popular items in a nine-course dinner program: BIRD’S NEST SOUP Soak one pound bird’s nest in cold water overnight. Drain the cold water and cook in boiling water. Drain again. Do this twice. Clean the bird’s nest. Be sure [...] Read more →

Click here to visit the New Yorkshire YouTube channel. Home Top of Pg. Read more →

AB Bookman’s 1948 Guide to Describing Conditions: As New is self-explanatory. It means that the book is in the state that it should have been in when it left the publisher. This is the equivalent of Mint condition in numismatics. Fine (F or FN) is As New but allowing for the normal effects of [...] Read more →

There is nothing more delightful than a great poetry reading to warm ones heart on a cold winter night fireside. Today is one of the coldest Valentine’s days on record, thus, nothing could be better than listening to the resonant voice of Robin Shuckbrugh, The Cotswold [...] Read more →

Click here to learn more about The Tallis Scholars Home Top of Pg. Read more →

Felix Weihs de Weldon, age 96, died broke in the year 2003 after successive bankruptcies and accumulating $4 million dollars worth of debt. Most of the debt was related to the high cost of love for a wife living with Alzheimer’s. Health care costs to maintain his first wife, Margot, ran $500 per [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

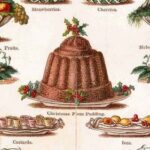

Country House Christmas Pudding Ingredients 1 cup Christian Bros Brandy ½ cup Myer’s Dark Rum ½ cup Jim Beam Whiskey 1 cup currants 1 cup sultana raisins 1 cup pitted prunes finely chopped 1 med. apple peeled and grated ½ cup chopped dried apricots ½ cup candied orange peel finely chopped 1 ¼ cup [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

THE FIRST step in producing a satisfactory crop of tobacco is to use good seed that is true to type. The grower often can save his own seed to advantage, if he wants to. Before topping is done, he should go over the tobacco field carefully to pick [...] Read more →

Bess of Harwick Four times the nuptial bed she warm’d, And every time so well perform’d, That when death spoil’d each husband’s billing, He left the widow every shilling. Fond was the dame, but not dejected; Five stately mansions she erected With more than royal pomp, to vary The prison of her captive When [...] Read more →

A Real Soda Jerk FORMULAS FROM VARIOUS SOURCES. Pineapple Frappe. Water, 1 gallon; sugar 2 pounds of water. 61/2 pints, and simple syrup. 2 1/2 pints; 2 pints of pineapple stock or 1 pint of pineapple stock and 1 pint of grated pineapple juice of 6 lemons. Mix, [...] Read more →

The rigging of an old square rig in London, United Kingdom. Photograph taken by Melongrower. Home Top of Pg. Read more →

Mortlake Tapestries at Chatsworth House Click here to learn more about the Mortlake Tapestries of Chatsworth The Mortlake Tapestries were founded by Sir Francis Crane. From the Dictionary of National Biography, 1885-1900, Volume 13 Crane, Francis by William Prideaux Courtney CRANE, Sir FRANCIS (d. [...] Read more →

To learn more about Julian McDonnell, film director, click here. Home Top of Pg. Read more →

STORE MANAGEMENT—THE SHIRK. THE shirk is a well-known specimen of the genus homo. His habitat is offices, stores, business establishments of all kinds. His habits are familiar to us, but a few words on the subject will not be amiss. The shirk usually displays activity when the boss is around, [...] Read more →

Absolutely Brilliant! And as I am quite certain you will become a fan, there’s more! Home Top of Pg. Read more →

Hernando de Soto (c1496-1542) Spanish explorer and his men torturing natives of Florida in his determination to find gold. Hand-coloured engraving. John Judkyn Memorial Collection, Freshford Manor, Bath The print above depicts Spanish explorer Hernando de Soto and his band of conquistadors torturing Florida natives in order to extract information on where [...] Read more →

Home Top of Pg. Read more →

It is unnecessary to point out that low-grade fruit may often be used to advantage in the preparation of vinegar. This has always been true in the case of apples and may be true with other fruit, especially grapes. The use of grapes for wine making is an outlet which [...] Read more →

CLAIRVOYANCE by C. W. Leadbeater Adyar, Madras, India: Theosophical Pub. House [1899] CHAPTER IX – METHODS OF DEVELOPMENT When a men becomes convinced of the reality of the valuable power of clairvoyance, his first question usually is, “How can [...] Read more →

Modern slow cookers come in all sizes and colors with various bells and whistles, including timers and shut off mechanisms. They also come with a serious design flaw, that being the lack of a proper domed lid. The first photo below depict a popular model Crock-Pot® sold far and wide [...] Read more →

New York Stock Exchange Floor September 26,1963 The Specialist as a member of a stock exchange has two functions.’ He must execute orders which other members of an exchange may leave with him when the current market price is away from the price of the orders. By executing these orders on behalf [...] Read more →

John Atkinson Grimshaw – Glasgow Saturday Night Home Top of Pg. Read more →

Artisans world-wide spend a fortune on commercial brand oil-based gold leaf sizing. The most popular brands include Luco, Dux, and L.A. Gold Leaf. Pricing for quart size containers range from $35 to $55 depending upon retailer pricing. Fast drying sizing sets up in 2-4 hours depending upon environmental conditions, humidity [...] Read more →

The Ardabil Carpet – Made in the town of Ardabil in north-west Iran, the burial place of Shaykh Safi al-Din Ardabili, who died in 1334. The Shaykh was a Sufi leader, ancestor of Shah Ismail, founder of the Safavid dynasty (1501-1722). While the exact origins of the carpet are unclear, it’s believed to have [...] Read more →

The following highly collectible Franklin Library Signed Editions were published between 1977 and 1982. They are all fully leather bound with beautiful covers and contain gorgeous and rich silk moire endpapers. Signatures are protected by unattached tissue inserts. The values listed are average prices that were sought by [...] Read more →

Dutch artist Herman de Vries – Photo taken by son Vince The two videos below of Herman de Vries at work at the Venice Bienalle 2015 are quite inspiring. So inspiring in fact that I moved into a cave for two weeks and wrote Shakespearean tragedy with charcoal. Filled with great joy [...] Read more →

Muscadine Jelly 6 cups muscadine grape juice 6 cups sugar 1 box Kraft Sure Gel or Ball Fruit Jell Home Top of [...] Read more →

Wojna Kalmarska – 1611 The Kalmar War From The Historian’s History of the World (In 25 Volumes) by Henry Smith William L.L.D. – Vol. XVI.(Scandinavia) Pg. 308-310 The northern part of the Scandinavian peninsula, as already noticed, had been peopled from the remotest times by nomadic tribes called Finns or Cwenas by [...] Read more →

Reprint from The Pitfalls of Speculation by Thomas Gibson 1906 Ed. THE PUBLIC ATTITUDE TOWARD SPECULATION THE public attitude toward speculation is generally hostile. Even those who venture frequently are prone to speak discouragingly of speculative possibilities, and to point warningly to the fact that an overwhelming majority [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

VHF Marifoon Sailor RT144, by S.J. de Waard RADIO INFORMATION FOR BOATERS Effective 01 August, 2013, the U. S. Coast Guard terminated its radio guard of the international voice distress, safety and calling frequency 2182 kHz and the international digital selective calling (DSC) distress and safety frequency 2187.5 kHz. Additionally, [...] Read more →

THE ABC OF THE FEDERAL RESERVE SYSTEM WH Y THE FEDERAL RESERVE SYSTEM WAS CALLED INTO BEING, THE MAIN FEATURES OF ITS ORGANIZATION , AND HOW IT WORKS B Y EDWIN WALTER KEMMERER, PH.D. PROFESSOR OF ECONOMICS AND FINANCE IN PRINCETON UNIVERSITY AND MEMBER OF [...] Read more →

Take the large blue figs when pretty ripe, and steep them in white wine, having made some slits in them, that they may swell and gather in the substance of the wine. Then slice some other figs and let them simmer over a fire in water until they are reduced [...] Read more →

San Felipe Model Reprinted from FineModelShips.com with the kind permission of Dr. Michael Czytko The SAN FELIPE is one of the most favoured ships among the ship model builders. The model is elegant, very beautifully designed, and makes a decorative piece of art to be displayed at home or in the [...] Read more →

A Lecture Delivered at the Guildhall, March 2, 1853 by Rev. H.M. Scarth, M.A., Rector of Bathwick. To understand the ancient history of the country in which we live, to know something of the arts and manners of the people who have preceded us, to ascertain what we owe [...] Read more →

Quite possibly, the most agonizing decision being made by Baby Boomers across the nation these days is what to do with all that vintage Hi-fi equipment and boxes full of classic rock and roll cassettes and 8-Tracks. I faced this dilemma head-on this past summer as I definitely wanted in [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

http://www.vermeerscamera.co.uk/home.htm Home Top of Pg. Read more →

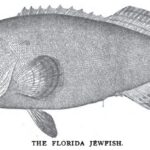

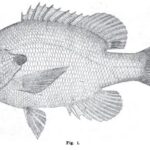

Nov. 5. 1898 Forest and Stream Pg. 371-372 The Black Grouper or Jewfish. New Smyrna, Fla., Oct. 21.—Editor Forest and Stream: It is not generally known that the fish commonly called jewfish. warsaw and black grouper are frequently caught at the New Smyrna bridge [...] Read more →

The first published illustration of Nicotiana tabacum by Pena and De L’Obel, 1570–1571 (shrpium adversana nova: London). Tobacco can be used for medicinal purposes, however, the ongoing American war on smoking has all but obscured this important aspect of ancient plant. Tobacco is considered to be an indigenous plant of [...] Read more →

The arsenicals (compounds which contain the heavy metal element arsenic, As) have a long history of use in man – with both benevolent and malevolent intent. The name ‘arsenic’ is derived from the Greek word ‘arsenikon’ which means ‘potent'”. As early as 2000 BC, arsenic trioxide, obtained from smelting copper, was used [...] Read more →

Click here to view a copy of Arban’s Complete Conservatory Method for Cornet Click on the blue button to download a free copy of Arban’s Complete Conservatory Method for Cornet Arban's - 11.8MB For trumpet players wishing to practice daily using an iPad, simply click [...] Read more →

Full Cover, rear, spine, and front Published by Piranesi Press in collaboration with Country House Essays, this beautiful paperback version of the King James Bible is now available for $79.95 at Barnes and Noble.com This is a limited Edition of 500 copies Worldwide. Click here to view other classic books [...] Read more →

The 1896 Victorian terracotta Bell Edison Telephone Building – 17 & 19 Newhall Street, Birmingham, England. A grade I listed building designed by Frederick Martin of the firm Martin & Chamberlain. Now offices for firms of architects. Photographed 10 May 2006 by Oosoom [Reprint from Victoria and Albert Museum included below on [...] Read more →

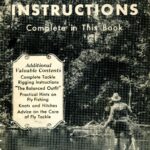

An angler with a costly pole Surmounted with a silver reel, Carven in quaint poetic scroll- Jointed and tipped with finest steel— With yellow flies, Whose scarlet eyes And jasper wings are fair to see, Hies to the stream Whose bubbles beam Down murmuring eddies wild and free. And casts the line with sportsman’s [...] Read more →

Cabildo circa 1936 The Cabildo houses a rare copy of Audubon’s Bird’s of America, a book now valued at $10 million+. Should one desire to visit the Cabildo, click here to gain free entry with a lowcost New Orleans Pass. Home Top of [...] Read more →

Paul Thorpe, Brighton, U.K. The YouTube watch collecting world is rather tight-knit and small, but growing, as watches became a highly coveted commodity during the recent world-wide pandemic and fueled an explosion of online watch channels. There is one name many know, The Time Piece Gentleman. This name for me [...] Read more →

Cleremont Club 44 Berkeley Square, London Home Top of Pg. Read more →

Click here to view more great Italian recipes. Home Top of Pg. Read more →

Liquorice, the roots of Glycirrhiza Glabra, a perennial plant, a native of the south of Europe, but cultivated to some extent in England, particularly at Mitcham, in Surrey. Its root, which is its only valuable part, is long, fibrous, of a yellow colour, and when fresh, very juicy. [...] Read more →

Mocking Bird Food. Hemp seed……….2 pounds Rape seed………. .1 pound Crackers………….1 pound Rice…………….1/4 pound Corn meal………1/4 pound Lard oil…………1/4 pound Home Top of Pg. Read more →

Welcome to Country House Essays. Enjoy. Home Top of Pg. Read more →

The element copper effectively kills viruses and bacteria. Therefore it would reason and I will assert and not only assert but lay claim to the patents for copper mesh stints to be inserted in the arteries of patients presenting with severe cases of Covid-19 with a slow release dosage of [...] Read more →

The Queen Elizabeth Trust, or QEST, is an organisation dedicated to the promotion of British craftsmanship through the funding of scholarships and educational endeavours to include apprenticeships, trade schools, and traditional university classwork. The work of QEST is instrumental in keeping alive age old arts and crafts such as masonry, glassblowing, shoemaking, [...] Read more →

Take to every quart of water one pound of Malaga raisins, rub and cut the raisins small, and put them to the water, and let them stand ten days, stirring once or twice a day. You may boil the water an hour before you put it to the raisins, and let it [...] Read more →

Country House Essays has returned after a good long summer holiday. More essays soon. Home Top of Pg. Read more →

Dominion, Royal St. Lawrence Yacht Club,Winner of Seawanhaka Cup, 1898. The Tail Wags the Dog. The following is a characteristic sample of those broad and liberal views on yachting which are the pride of the Boston Herald. Speaking of the coming races for the Seawanhaka international challenge cup, it says: [...] Read more →

Reprint from the Sportsman Cabinet and Town & Country Magazine, Vol.1, Number 1, November 1832. MR. Editor, Will you allow me to inquire, through the medium of your pages, the correct meaning of the term thorough-bred fox-hound? I am very well aware, that the expression is in common [...] Read more →

Banana Propagation Reprinted from the International Institute of Tropical Agriculture (IITA.org) The traditional means of obtaining banana planting material (“seed”) is to acquire suckers from one’s own banana garden, from a neighbor, or from a more distant source. This method served to spread common varieties around the world and to multiply them [...] Read more →

The low level of work stoppages of recent years also attests to concern about job security. Testimony of Chairman Alan Greenspan The Federal Reserve’s semiannual monetary policy report Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate February 26, 1997 Iappreciate the opportunity to appear before this Committee [...] Read more →

Salmon and Sturgeon Caviar – Photo by Thor Salmon caviar was originated about 1910 by a fisherman in the Maritime Provinces of Siberia, and the preparation is a modification of the sturgeon caviar method (Cobb 1919). Salomon caviar has found a good market in the U.S.S.R. and other European countries where it [...] Read more →

Gary Kravit is an airline pilot and artist. He also owns and operates https://theultimatetaboret.com. You may view Gary’s art at https://garrykravitart.blogspot.com/ Home Top of Pg. Read more →

Home Top of Pg. Read more →

FRIED SQUIRREL & BISCUIT GRAVY 3-4 Young Squirrels, dressed and cleaned 1 tsp. Morton Salt or to taste 1 tsp. McCormick Black Pepper or to taste 1 Cup Martha White All Purpose Flour 1 Cup Hog Lard – Preferably fresh from hog killing, or barbecue table Cut up three to [...] Read more →

Are you considering purchasing a copper water pitcher for storing drinking water but have questions about the effects on your health? The following study may help jump-start your research. Storing Drinking-water in Copper pots Kills Contaminating Diarrhoeagenic Bacteria ABSTRACT Microbially-unsafe water is [...] Read more →

Linseed oil is readily available in many oil painters’ studios. Yardley London Shea Butter Soap can be purchased from a dollar store or pound shop on the cheap. These two ingredients make for the basis of an excellent cleaning system for cleaning oil painting brushes. Home Top of [...] Read more →

The following cure was found written on a front flyleaf in an 1811 3rd Ed. copy of The Sportsman’s Guide or Sportsman’s Companion: Containing Every Possible Instruction for the Juvenille Shooter, Together with Information Necessary for the Experienced Sportsman by B. Thomas. Transcript: Vaccinate your dogs when young [...] Read more →

German made shotguns by Krieghoff, founded in 1886. Home Top of Pg. Read more →

It is a pity that the traditions and literature in praise of fly fishing have unconsciously hampered instead of expanded this graceful, effective sport. Many a sportsman has been anxious to share its joys, but appalled by the rapture of expression in describing its countless thrills and niceties he has been literally [...] Read more →

July 9, 1898. Forest and Stream Pg. 25 Some Notes on American Ship-Worms. [Read before the American Fishes Congress at Tampa.] While we wish to preserve and protect most of the products of our waters, these creatures we would gladly obliterate from the realm of living things. For [...] Read more →

Any prudent investor would jump at the chance to receive a guaranteed 6% dividend for life. So how does one get in on this action? The fact of the matter is…YOU can’t…That is unless you are a shareholder of one of the twelve Federal Reserve Banks and the banks under [...] Read more →

|

Furniture Polishing Cream. Animal oil soap…………………….1 onuce Solution of potassium hydroxide…. .5 ounces Beeswax……………………………1 pound Oil of turpentine…………………..3 pints Water, enough to make……………..5 pints Dissolve the soap in the lye with the aid of heat; add this solution all at once to the warm solution of the wax in the oil. Beat [...] Read more →

Reprint from The Pitfalls of Speculation by Thomas Gibson 1906 Ed. THE PUBLIC ATTITUDE TOWARD SPECULATION THE public attitude toward speculation is generally hostile. Even those who venture frequently are prone to speak discouragingly of speculative possibilities, and to point warningly to the fact that an overwhelming majority [...] Read more →

THE ABC OF THE FEDERAL RESERVE SYSTEM WH Y THE FEDERAL RESERVE SYSTEM WAS CALLED INTO BEING, THE MAIN FEATURES OF ITS ORGANIZATION , AND HOW IT WORKS B Y EDWIN WALTER KEMMERER, PH.D. PROFESSOR OF ECONOMICS AND FINANCE IN PRINCETON UNIVERSITY AND MEMBER OF [...] Read more →

Over the years I have observed a decline in manners amongst young men as a general principle and though there is not one particular thing that may be asserted as the causal reason for this, one might speculate… Self-awareness and being aware of one’s surroundings in social interactions [...] Read more →

Biograph Theater, where John Dillinger was gunned down by the FBI on July 22, 1934 The Great Depression was on—highway based crime was rampant, the gangsters dressed as well as the bankers they robbed, and and Henry Ford’s big beautiful V8 sedan was the getaway car of choice for both wheelman and [...] Read more →

Artisans world-wide spend a fortune on commercial brand oil-based gold leaf sizing. The most popular brands include Luco, Dux, and L.A. Gold Leaf. Pricing for quart size containers range from $35 to $55 depending upon retailer pricing. Fast drying sizing sets up in 2-4 hours depending upon environmental conditions, humidity [...] Read more →

In July of 1968, the National Aeronautics and Space Administration(NASA), published NASA Technical Report TR R-277 titled Chronological Catalog of Recorded Lunar Events. The catalog begins with the first entry dated November 26th, 1540 at ∼05h 00m: Feature: Region of Calippus2 Description: Starlike appearance on dark side Observer: Observers at Worms Reference: [...] Read more →

A la Russie, aux ânes et aux autres – by Chagall – 1911 Marc Chagall is one of the most forged artists on the planet. Mark Rothko fakes also abound. According to available news reports, the art market is littered with forgeries of their work. Some are even thought to be [...] Read more →

Absolutely Brilliant! And as I am quite certain you will become a fan, there’s more! Home Top of Pg. Read more →

Home Top of Pg. Read more →

THE HATHA YOGA PRADIPIKA Translated into English by PANCHAM SINH Panini Office, Allahabad [1914] INTRODUCTION. There exists at present a good deal of misconception with regard to the practices of the Haṭha Yoga. People easily believe in the stories told by those who themselves [...] Read more →

Banana Propagation Reprinted from the International Institute of Tropical Agriculture (IITA.org) The traditional means of obtaining banana planting material (“seed”) is to acquire suckers from one’s own banana garden, from a neighbor, or from a more distant source. This method served to spread common varieties around the world and to multiply them [...] Read more →

It was a strange assignment. I picked up the telegram from desk and read it a third time. NEW YORK, N.Y., MAY 9, 1949 HAVE BEEN INVESTIGATING FLYING SAUCER MYSTERY. FIRST TIP HINTED GIGANTIC HOAX TO COVER UP OFFICIAL SECRET. BELIEVE IT MAY HAVE BEEN PLANTED TO HIDE [...] Read more →

The Hunt Saboteur is a national disgrace barking out loud, black mask on her face get those dogs off, get them off she did yell until a swift kick from me mare her voice it did quell and sent the Hunt Saboteur scurrying up vale to the full cry of hounds drowning out her [...] Read more →

The following research discussion is from a study funded by the U.S. National Institute of Health entitled: Boschniakia rossica prevents the carbon tetrachloride-induced hepatotoxicity in rat. It may be of interest to heavy drinkers. Home Top of [...] Read more →

Baking is a very similar process to roasting: the two often do duty for one another. As in all other methods of cookery, the surrounding air may be several degrees hotter than boiling water, but the food is no appreciably hotter until it has lost water by evaporation, after which it may [...] Read more →

Home Top of Pg. Read more →

King Arthur, Legends, Myths & Maidens is a massive book of Arthurian legends. This limited edition paperback was just released on Barnes and Noble at a price of $139.00. Although is may seem a bit on the high side, it may prove to be well worth its price as there are only [...] Read more →

CENTRAL INTELLIGENCE AGENCY INROMATION FROM FOREIGN DOCUMENT OR RADIO BROADCASTS COUNTRY: Non-Orbit SUBJECT: Military – Air – Scientific – Aeronautics HOW PUBLISHED: Newspapers WHERE PUBLISHED: As indicated DATE PUBLISHED: 12 Dec 1953 – 12 Jan 1954 LANGUAGE: Various SOURCE: As indicated REPORT NO. 00-W-30357 DATE OF INFORMATION: 1953-1954 DATE DIST. 27 [...] Read more →

Mudlarks of London Mudlarking along the Thames River foreshore is controlled by the Port of London Authority. According to the Port of London website, two type of permits are issued for those wishing to conduct metal detecting, digging, or searching activities. Standard – allows digging to a depth of 7.5 [...] Read more →

Hebborn Piranesi Before meeting with an untimely death at the hand of an unknown assassin in Rome on January 11th, 1996, master forger Eric Hebborn put down on paper a wealth of knowledge about the art of forgery. In a book published posthumously in 1997, titled The Art Forger’s Handbook, Hebborn suggests [...] Read more →

Country House Christmas Pudding Ingredients 1 cup Christian Bros Brandy ½ cup Myer’s Dark Rum ½ cup Jim Beam Whiskey 1 cup currants 1 cup sultana raisins 1 cup pitted prunes finely chopped 1 med. apple peeled and grated ½ cup chopped dried apricots ½ cup candied orange peel finely chopped 1 ¼ cup [...] Read more →

King Leopold Butcher of the Congo For the somewhat startling suggestion in the heading of this interview, the missionary interviewed is in no way responsible. The credit of it, or, if you like, the discredit, belongs entirely to the editor of the Review, who, without dogmatism, wishes to pose the question as [...] Read more →

Testing the Irish Blue Terrier Breed in 1923. Home Top of Pg. Read more →

From Allen’s Indian Mail, December 3rd, 1851 BOMBAY. MUSULMAN FANATICISM. On the evening of November 15th, the little village of Mahim was the scene of a murder, perhaps the most determined which has ever stained the annals of Bombay. Three men were massacred in cold blood, in a house used [...] Read more →

The greatest cause of failure in vinegar making is carelessness on the part of the operator. Intelligent separation should be made of the process into its various steps from the beginning to end. PRESSING THE JUICE The apples should be clean and ripe. If not clean, undesirable fermentations [...] Read more →

by John Partridge,drawing,1825 From the work of Sir Charles Lock Eastlake entitled Materials for a history of oil painting, (London: Longman, Brown, Green, and Longmans, 1846), we learn the following: The effect of oil at certain temperatures, in penetrating “the minute pores of the amber” (as Hoffman elsewhere writes), is still more [...] Read more →

Home Top of Pg. Read more →

Any prudent investor would jump at the chance to receive a guaranteed 6% dividend for life. So how does one get in on this action? The fact of the matter is…YOU can’t…That is unless you are a shareholder of one of the twelve Federal Reserve Banks and the banks under [...] Read more →

How happy is he born and taught. That serveth not another’s will; Whose armour is his honest thought, And simple truth his utmost skill Whose passions not his masters are; Whose soul is still prepared for death, Untied unto the world by care Of public fame or private breath; Who envies none that chance [...] Read more →

Video courtesy of Imperial War Museums, UK Home Top of Pg. Read more →

Paul Thorpe, Brighton, U.K. The YouTube watch collecting world is rather tight-knit and small, but growing, as watches became a highly coveted commodity during the recent world-wide pandemic and fueled an explosion of online watch channels. There is one name many know, The Time Piece Gentleman. This name for me [...] Read more →

TROF. C. F. HOLDFER AND HIS 183LBS. TUNA, WITH BOATMAN JIM GARDNER. July 2, 1898. Forest and Stream Pg. 11 The Tuna Record. Avalon. Santa Catalina Island. Southern California, June 16.—Editor Forest and Stream: Several years ago the writer in articles on the “Game Fishes of the Pacific Slope,” in [...] Read more →

Home Top of Pg. Read more →

Reprint from The Royal Collection Trust website: Kneller was born in Lubeck, studied with Rembrandt in Amsterdam and by 1676 was working in England as a fashionable portrait painter. He painted seven British monarchs (Charles II, James II, William III, Mary II, Anne, George I and George II), though his [...] Read more →

Edwin Austin Abbey. King Lear, Act I, Scene I (Cordelia’s Farewell) The Metropolitan Museum of Art. Dates: 1897-1898 Dimensions: Height: 137.8 cm (54.25 in.), Width: 323.2 cm (127.24 in.) Medium: Painting – oil on canvas Home Top of Pg. Read more →

Audubon started to develop a special technique for drawing birds in 1806 a Mill Grove, Pennsylvania. He perfected it during the long river trip from Cincinnati to New Orleans and in New Orleans, 1821. Home Top of [...] Read more →

Home Top of Pg. Read more →

Painting the Brooklyn Bridge, Photo by Eugene de Salignac , 1914 Excerpt from: The Preservation of Iron and Steel Structures by F. Cosby-Jones, The Mechanical Engineer January 30, 1914 Painting. This is the method of protection against corrosion that has the most extensive use, owing to the fact that [...] Read more →

Fed Chariman William McChesney Martin – 1952-1970 [Editor note: This response in my mind is quite hilarious…and to the point…who the heck would want to give up 6% interest year after year after year after year? ] You HAVE ASKED that I appear before you today in connection with your consideration [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

VITRUVIUS The Ten Books on Architecture TRANSLATED By MORRIS HICKY MORGAN, PH.D., LL.D. LATE PROFESSOR OF CLASSICAL PHILOLOGY IN HARVARD UNIVERSITY WITH ILLUSTRATIONS AND ORIGINAL DESINGS PREPARED UNDER THE DIRECTION OF HERBERT LANGFORD WARREN, A.M. NELSON ROBINSON JR. PROFESSOR OF ARCHITECTURE IN HARVARD [...] Read more →

Mortlake Tapestries at Chatsworth House Click here to learn more about the Mortlake Tapestries of Chatsworth The Mortlake Tapestries were founded by Sir Francis Crane. From the Dictionary of National Biography, 1885-1900, Volume 13 Crane, Francis by William Prideaux Courtney CRANE, Sir FRANCIS (d. [...] Read more →

Home Top of Pg. Read more →

AB Bookman’s 1948 Guide to Describing Conditions: As New is self-explanatory. It means that the book is in the state that it should have been in when it left the publisher. This is the equivalent of Mint condition in numismatics. Fine (F or FN) is As New but allowing for the normal effects of [...] Read more →

Dutch artist Herman de Vries – Photo taken by son Vince The two videos below of Herman de Vries at work at the Venice Bienalle 2015 are quite inspiring. So inspiring in fact that I moved into a cave for two weeks and wrote Shakespearean tragedy with charcoal. Filled with great joy [...] Read more →

Home Top of Pg. Read more →

Reprint from The Sportsman’s Cabinet and Town and Country Magazine, Vol I. Dec. 1832, Pg. 94-95 To the Editor of the Cabinet. SIR, Possessing that anxious feeling so common among shooters on the near approach of the 12th of August, I honestly confess I was not able [...] Read more →

WITCHCRAFT, SORCERY, MAGIC AND OTHER PSYCHOLOGICAL PHENOMENA AND THEIR IMPLICATIONS ON MILITARY AND PARAMILITARY OPERATIONS IN THE CONGO This report has been prepared in response to a query posed by ODCS/OPS, Department of the Army, regarding the purported use of witchcraft, sorcery, and magic by insurgent elements in the Republic [...] Read more →

Gate of Honour, Caius Court, Gonville & Caius Gonville & Caius College, known as Caius and pronounced keys was founded in 1348 by Edmund Gonville, the Rector of Terrington St Clement in Norfolk. The first name was thus Goville Hall and it was dedicated to the Annunciation of the Blessed Virgin Mary. [...] Read more →

THE SNIPE, from the Shooter’s Guide by B. Thomas – 1811 AFTER having given a particular description of the woodcock, it will only. be necessary to observe, that the plumage and shape of the snipe is much the same ; and indeed its habits and manners sets bear a great [...] Read more →

Click here to visit the New Yorkshire YouTube channel. Home Top of Pg. Read more →

H. M. Scarth, Rector of Wrington By the death of Mr. Scarth on the 5th of April, at Tangier, where he had gone for his health’s sake, the familiar form of an old and much valued Member of the Institute has passed away. Harry Mengden Scarth was bron at Staindrop in Durham, [...] Read more →

Como dome facade – Pliny the Elder – Photo by Wolfgang Sauber Work in Progress… THE VARNISHES. Every substance may be considered as a varnish, which, when applied to the surface of a solid body, gives it a permanent lustre. Drying oil, thickened by exposure to the sun’s heat or [...] Read more →

Photo Caption: The Marquis of Zetland, KC, PC – otherwise known as Lawrence Dundas Son of: John Charles Dundas and: Margaret Matilda Talbot born: Friday 16 August 1844 died: Monday 11 March 1929 at Aske Hall Occupation: M.P. for Richmond Viceroy of Ireland Vice Lord Lieutenant of North Yorkshire Lord – in – Waiting [...] Read more →

Click here to purchase a copy of The Trump Bible at Barnes and Noble Home Top of Pg. Read more →

Tom Oates, aka Nabokov at en.wikipedia No two commercial tuna salads are prepared by exactly the same formula, but they do not show the wide variety characteristic of herring salad. The recipe given here is typical. It is offered, however, only as a guide. The same recipe with minor variations to suit [...] Read more →

Welcome to Country House Essays. Enjoy. Home Top of Pg. Read more →

? This video by AT Restoration is the best hands on video I have run across on the basics of classic upholstery. Watch a master at work. Simply amazing. Tools: Round needles: https://amzn.to/2S9IhrP Double pointed hand needle: https://amzn.to/3bDmWPp Hand tools: https://amzn.to/2Rytirc Staple gun (for beginner): https://amzn.to/2JZs3x1 Compressor [...] Read more →

July 9, 1898. Forest and Stream Pg. 25 Some Notes on American Ship-Worms. [Read before the American Fishes Congress at Tampa.] While we wish to preserve and protect most of the products of our waters, these creatures we would gladly obliterate from the realm of living things. For [...] Read more →

Home Top of Pg. Read more →

Gary Kravit is an airline pilot and artist. He also owns and operates https://theultimatetaboret.com. You may view Gary’s art at https://garrykravitart.blogspot.com/ Home Top of Pg. Read more →

Half a league, half a league, Half a league onward, All in the valley of Death Rode the six hundred. “Forward, the Light Brigade! Charge for the guns!” he said. Into the valley of Death Rode the six hundred. Home Top of [...] Read more →

The following highly collectible Franklin Library Signed Editions were published between 1977 and 1982. They are all fully leather bound with beautiful covers and contain gorgeous and rich silk moire endpapers. Signatures are protected by unattached tissue inserts. The values listed are average prices that were sought by [...] Read more →

Wojna Kalmarska – 1611 The Kalmar War From The Historian’s History of the World (In 25 Volumes) by Henry Smith William L.L.D. – Vol. XVI.(Scandinavia) Pg. 308-310 The northern part of the Scandinavian peninsula, as already noticed, had been peopled from the remotest times by nomadic tribes called Finns or Cwenas by [...] Read more →

BLACKBERRY WINE 5 gallons of blackberries 5 pound bag of sugar Fill a pair of empty five gallon buckets half way with hot soapy water and a ¼ cup of vinegar. Wash thoroughly and rinse. Fill one bucket with two and one half gallons of blackberries and crush with [...] Read more →

Linseed oil is readily available in many oil painters’ studios. Yardley London Shea Butter Soap can be purchased from a dollar store or pound shop on the cheap. These two ingredients make for the basis of an excellent cleaning system for cleaning oil painting brushes. Home Top of [...] Read more →

Saint Francis of Assisi, founder of the mendicant Order of Friars Minor, as painted by El Greco. Catholic religious order Catholic religious orders are one of two types of religious institutes (‘Religious Institutes’, cf. canons 573–746), the major form of consecrated life in the Roman Catholic Church. They are organizations of laity [...] Read more →

Over the years I have observed a decline in manners amongst young men as a general principle and though there is not one particular thing that may be asserted as the causal reason for this, one might speculate… Self-awareness and being aware of one’s surroundings in social [...] Read more →

Cleaner for Gilt Frames. Calcium hypochlorite…………..7 oz. Sodium bicarbonate……………7 oz. Sodium chloride………………. 2 oz. Distilled water…………………12 oz. Home Top of Pg. Read more →

Wine Making Grapes are the world’s leading fruit crop and the eighth most important food crop in the world, exceeded only by the principal cereals and starchytubers. Though substantial quantities are used for fresh fruit, raisins, juice and preserves, most of the world’s annual production of about 60 million [...] Read more →

Click here to view more great Italian recipes. Home Top of Pg. Read more →

IT requires a far search to gather up examples of furniture really representative in this kind, and thus to gain a point of view for a prospect into the more ideal where furniture no longer is bought to look expensively useless in a boudoir, but serves everyday and commonplace need, such as [...] Read more →

Home Top of Pg. Read more →

Notes on the intaglio processes of the most expensive book on birds available for sale in the world today. The Audubon prints in “The Birds of America” were all made from copper plates utilizing four of the so called “intaglio” processes, engraving, etching, aquatint, and drypoint. Intaglio [...] Read more →

Roger Scruton by Peter Helm This is one of those videos that the so-called intellectual left would rather not be seen by the general public as it makes a laughing stock of the idiots running the artworld, a multi-billion dollar business. https://archive.org/details/why-beauty-matters-roger-scruton or Click here to watch [...] Read more →

THE FIRST step in producing a satisfactory crop of tobacco is to use good seed that is true to type. The grower often can save his own seed to advantage, if he wants to. Before topping is done, he should go over the tobacco field carefully to pick [...] Read more →

Jul. 23, 1898 Forest and Stream, Pg. 65 Horn Measurements. Editor Forest and Stream: “Record head.” How shamefully this term is being abused, especially in the past three years; or since the giant moose from Alaska made his appearance in public and placed all former records (so far as [...] Read more →

To Choose Poultry. When fresh, the eyes should be clear and not sunken, the feet limp and pliable, stiff dry feet being a sure indication that the bird has not been recently killed; the flesh should be firm and thick and if the bird is plucked there should be no [...] Read more →

Home Top of [...] Read more →

Mocking Bird Food. Hemp seed……….2 pounds Rape seed………. .1 pound Crackers………….1 pound Rice…………….1/4 pound Corn meal………1/4 pound Lard oil…………1/4 pound Home Top of Pg. Read more →

A terrestial globe on which the tracts and discoveries are laid down from the accurate observations made by Capts Cook, Furneux, Phipps, published 1782 / globe by John Newton ; cartography by William Palmer, held by the State Library of New South Wales The British Library, using sophisticated filming equipment and software, [...] Read more →

Take the large blue figs when pretty ripe, and steep them in white wine, having made some slits in them, that they may swell and gather in the substance of the wine. Then slice some other figs and let them simmer over a fire in water until they are reduced [...] Read more →

From the classic British Movie, The Shooting Party, a 1985 British drama film directed by Alan Bridges based on Isabel Colegate’s 9th novel of the same name published in 1980 we find a scene set in the billiards parlor whereupon the host of the weekend shooting party Sir Randolph Nettleby walks in [...] Read more →

FRIED SQUIRREL & BISCUIT GRAVY 3-4 Young Squirrels, dressed and cleaned 1 tsp. Morton Salt or to taste 1 tsp. McCormick Black Pepper or to taste 1 Cup Martha White All Purpose Flour 1 Cup Hog Lard – Preferably fresh from hog killing, or barbecue table Cut up three to [...] Read more →

“The Leda, in the Colonna palace, by Correggio, is dead-coloured white and black, with ultramarine in the shadow ; and over that is scumbled, thinly and smooth, a warmer tint,—I believe caput mortuum. The lights are mellow ; the shadows blueish, but mellow. The picture is painted on panel, in [...] Read more →

For years in the West African nation of Ghana medicine men have used a root and leaves from a plant called nibima(Cryptolepis sanguinolenta) to kill the Plasmodium parasite transmitted through a female mosquito’s bite that is the root cause of malaria. A thousand miles away in India, a similar(same) plant [...] Read more →

If ever it could be said that there is such a thing as miracle healing soil, Ivan Sanderson said it best in his 1965 book entitled Ivan Sanderson’s Book of Great Jungles. Sanderson grew up with a natural inclination towards adventure and learning. He hailed from Scotland but spent much [...] Read more →

Country House Essays has returned after a good long summer holiday. More essays soon. Home Top of Pg. Read more →

Home Top of Pg. Read more →

Take to every quart of water one pound of Malaga raisins, rub and cut the raisins small, and put them to the water, and let them stand ten days, stirring once or twice a day. You may boil the water an hour before you put it to the raisins, and let it [...] Read more →

Click here to read the full text of the Hunting Act – 2004 Home Top of Pg. Read more →

An angler with a costly pole Surmounted with a silver reel, Carven in quaint poetic scroll- Jointed and tipped with finest steel— With yellow flies, Whose scarlet eyes And jasper wings are fair to see, Hies to the stream Whose bubbles beam Down murmuring eddies wild and free. And casts the line with sportsman’s [...] Read more →

Home Top of Pg. Read more →

The Apex Building, headquarters of the Federal Trade Commission, on Constitution Avenue and 7th Streets in Washington, D.C.. The building was designed by Edward H. Bennett under the purview of Secretary of the Treasury Andrew W. Mellon, and was completed in 1938 at a cost of $125 million. Photo by Carol M. Highsmith [...] Read more →

Home Top of Pg. Read more →

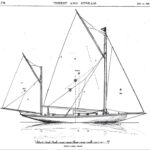

Dec. 10, 1898 Forest and Stream Pg. 477-479 Zulu. The little ship shown in the accompanying plans needs no description, as she speaks for herself, a handsome and shipshape craft that a man may own for years without any fear that she will go to pieces [...] Read more →

Home Top of Pg. Read more →

Home Top of Pg. Read more →

Foie gras with Sauternes, Photo by Laurent Espitallier As an Appetizer Pale dry Sherry, with or without bitters, chilled or not. Plain or mixed Vermouth, with or without bitters. A dry cocktail. With Oysters, Clams or Caviar A dry flinty wine such as Chablis, Moselle, Champagne. Home Top of [...] Read more →

Reprint from the Royal Collection Trust Website The meeting between Henry VIII and Francis I, known as the Field of the Cloth of Gold, took place between 7 to 24 June 1520 in a valley subsequently called the Val d’Or, near Guisnes to the south of Calais. The [...] Read more →

Gold Home Top of Pg. Read more →

The element copper effectively kills viruses and bacteria. Therefore it would reason and I will assert and not only assert but lay claim to the patents for copper mesh stints to be inserted in the arteries of patients presenting with severe cases of Covid-19 with a slow release dosage of [...] Read more →

Patek Phillipe hand makes the finest watches in the world. Click here to learn more. Home Top of Pg. Read more →

Vishnu as the Cosmic Man (Vishvarupa) Opaque watercolour on paper – Jaipur, Rajasthan c. 1800-50 CLAIRVOYANCE AND OCCULT POWERS By Swami Panchadasi Copyright, 1916 By Advanced Thought Pub. Co. Chicago, Il INTRODUCTION. In preparing this series of lessons for students of [...] Read more →

NAPOLEON’S PHARMACISTS. Of the making of books about Napoleon there is no end, and the centenary of his death (May 5) is not likely to pass without adding to the number, but a volume on Napoleon”s pharmacists still awaits treatment by the student in this field of historical research. There [...] Read more →